Markets for the People

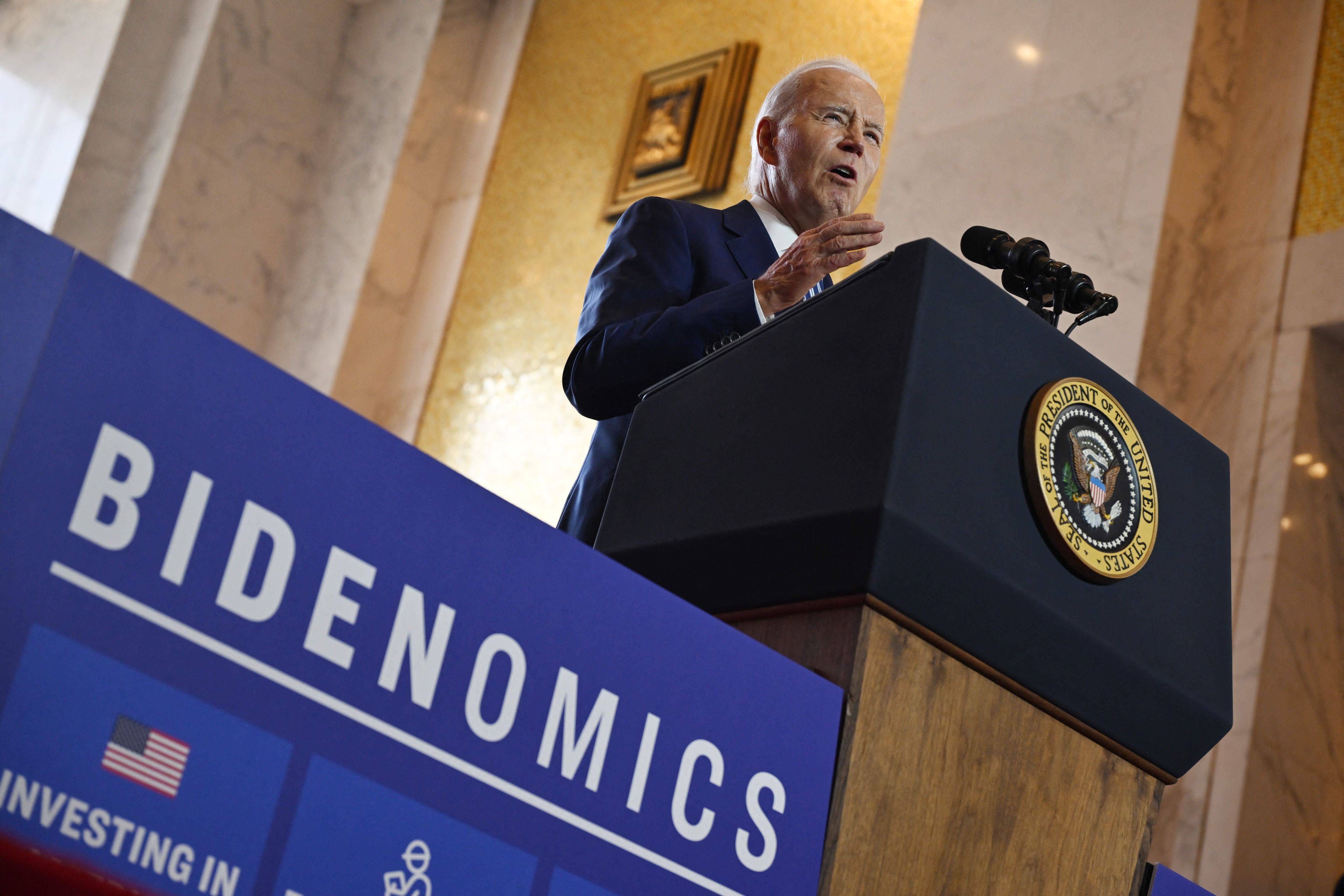

The advent of "Bidenomics" has resurrected decades-old debates about the merits of markets versus industrial policy. When President Joe Biden announced his eponymous strategy in June 2023, he blasted what he described as "40 years of Republican trickle-down economics" and insisted that he would seek instead to build "an economy from the middle out and the bottom up, not the top down." He would achieve this through "targeted investments" in technologies like semiconductors, batteries, and electric cars — all of which featured heavily in initiatives like the CHIPS and Science Act and the Inflation Reduction Act. Yet despite the president's professed support for a "middle out" economics, Bidenomics has thus far proven to be less of an intellectual framework than a set of well-intended yet ill-fated industrial-policy interventions implemented from the top down.

Some conservatives have joined Biden in embracing industrial policy. Writing recently in these pages, Republican senator Marco Rubio of Florida asserted that while it is difficult to "get industrial policy right, conservatives can and must take ownership of this space to keep the American economy strong and free." Former president Donald Trump, for his part, staunchly advocates heavy tariffs to promote domestic manufacturing.

Conservatives who adopt their own version of protectionist tinkering with markets are missing an important opportunity. As mercantilism's decline did for classical liberalism in the 19th century and Keynesianism's misadventures did for neoliberalism in the 20th, Bidenomics' failures offer an opening for the right to champion a new type of economics — one that puts opportunity for the people ahead of the economic rules of the game.

Rapid globalization and technological change have left too many Americans behind. But the answer is not for the state to invest in costly projects with dubious prospects, nor is it to adopt a strictly laissez-faire approach to the economy. By reviving classically liberal ideas about competition and opportunity in the face of change, conservatives can promote an alternative economics that retains the enormous benefits of markets and openness while putting people first.

LIBERALISM'S RISE AND FALL

Before "Bidenomics" became a popular term, national-security advisor Jake Sullivan hinted at the president's economic priorities in an April 2023 speech at the Brookings Institution. There, he declared that a "new Washington consensus" had formed around a "modern industrial and innovation strategy," which would correct for the excesses of the free-market orthodoxy propagated by the likes of Adam Smith, Friedrich Hayek, and Milton Friedman.

This orthodoxy, according to Sullivan, "championed tax cutting and deregulation, privatization over public action, and trade liberalization as an end in itself," all of which eroded the nation's industrial and social foundations. Finally, after nearly three decades of such policies, two "shocks" — the global financial crisis of 2007-2009 and the Covid-19 pandemic — "laid bare the limits" of liberalism. The time had come, Sullivan concluded, to dispense with decades of policies touting the benefits of markets and free trade — and economists would just have to get over it.

The Biden administration's assault on open markets and free trade is odd in some respects. Scholars at the Peterson Institute for International Economics — located just across the street from Brookings — concluded in a 2022 report that, thanks to America's openness to globalization, trillions of dollars in economic benefits have flowed to U.S. households. Moreover, the United Nations estimates that integrating China, India, and other economies into the world trading order has brought one billion individuals out of poverty since the 1980s. The impact of technological change as a driver of growth and incomes is larger still. Juxtaposing such outcomes with the administration's grievances calls to mind the popular outcry in Monty Python's Life of Brian: "What have the Romans ever done for us?" Quite a lot, in fact.

Proponents of free markets have clashed with advocates of government intervention before, most notably at the dawn of classical liberalism toward the end of the 18th century and the advent of neoliberalism during the first half of the 20th. These contests were not so much battles of ideas as they were intellectual critiques of real-life policy failures.

In 1776, Adam Smith's Inquiry into the Nature and Causes of the Wealth of Nations threw down the gauntlet. The book was radical, offering a sharp rebuke of the economic-policy order of the day. Mercantilism — or the "mercantile system," as Smith called it — assumed that the world's wealth is fixed, and that a state wishing to improve its relative financial strength would have to do so at the expense of others by maintaining a favorable balance of trade — typically by restricting imports while encouraging exports. Recognizing merchants' role in generating domestic wealth, mercantilist states also developed government-controlled monopolies that they protected from domestic and foreign competition through regulations, subsidies, and even military force.

Predictably, this system enriched the merchant class. But it did so at the expense of the poor, who were subject to trade restrictions and import taxes that drove up the price of goods. It also stunted business growth, expanded the slave trade, and triggered inflation in regions with little gold and silver bullion on hand.

Smith turned the mercantilist view on its head, insisting that the real touchstone of "the wealth of a nation" was not the amount of gold and silver held in its treasury, but the value of the goods and services it produced for its citizens to consume. To maximize a nation's wealth, he argued that the state should unleash its population's productive capacity by liberating markets and trade. Setting markets free, he observed, would enable firms to specialize in generating the goods they produced most efficiently, and to exchange surpluses of those goods for specialized goods produced by others. This approach would spread the benefits of free trade throughout the population.

While sometimes caricatured as a full-throated endorsement of laissez-faire economics, Wealth of Nations also recognized that government played an important role in sustaining an environment that would allow free markets to flourish. This included protecting property rights, building and maintaining infrastructure, upholding law and order, promoting education, providing for national security, and ensuring competition among firms. Smith cautioned, however, that government officials should be careful not to distort markets unnecessarily through such mechanisms as taxation and overregulation, and should avoid accumulating large public debts that would drain capital from future productive activities.

Mercantilism did not suddenly fall away after Smith's critique; it continued to dominate much of the world's economic order for another half-century. But eventually, Smith's arguments in favor of market liberalization carried the day. For much of the 19th and early 20th centuries, free markets and free trade facilitated unprecedented prosperity in the West.

A parallel series of events occurred during the 1930s and '40s, when Friedrich Hayek and John Maynard Keynes famously (and nastily) debated economic theory in the pages of the Economic Journal. That contest, too, revolved around what was happening on the ground: the Great Depression and increasing government investment in industry. Keynes contended that market economies experience booms and busts based on fluctuations in aggregate demand, and that the government could mitigate the harms of recessions by stimulating that demand through increased spending. Hayek disagreed, arguing that such large-scale public spending programs as those Keynes proposed would prompt not just market inefficiency and inflation, but tyranny.

During the 1950s and '60s, Milton Friedman took on Keynes's theories, asserting instead that the key to stimulating and maintaining economic growth was to control the money supply. He also expanded on Hayek's case for free markets as necessary elements of free societies: As he wrote in Capitalism and Freedom, economic freedom serves as both "a component of freedom broadly understood" and "an indispensable means toward the achievement of political freedom."

Of course Hayek and Friedman, like Smith before them, did not immediately win the debate; Keynesianism dominated America's economic policy for decades after the Second World War. But by the mid-1970s, rising inflation and slowed economic growth pressured policymakers to consider a different approach. Hayek and Friedman's arguments — now often referred to collectively as "neoliberalism" — ultimately won over important political figures like Ronald Reagan and Bill Clinton in the United States and Margaret Thatcher and Tony Blair in Britain. It had a major impact on each of their economic-policy initiatives, which typically combined tax cuts and deregulation with reduced government spending and liberalized international trade.

The upshot of that liberal market order is reflected in the 2022 findings of the Peterson Institute outlined above — namely the trillions of dollars in economic benefits that have flowed to American households. In a similar vein, the institute found in a 2017 report that between 1950 and 2016, trade liberalization combined with cheaper transportation and communication owing to technological change increased per-household GDP in the United States by about $18,000. The benefits of economic liberalism have thus been and continue to be massive.

NEOLIBERAL OVERCORRECTION

For all the prosperity it brought to the world, market-induced change in an era of globalization and rapid technological advance also entailed significant costs. Leaders across the political spectrum celebrated the former but paid little attention to the latter, which hit low- and medium-skilled American workers particularly hard. As global competition intensified and technological change mounted, tens of thousands of Americans in the manufacturing industry lost their jobs. Meanwhile, state benefits programs and occupational-licensing requirements made it difficult, if not impossible, for these individuals to move in search of better opportunities.

Neoliberal economic logic asserts that maintaining the labor market's dynamism will right the ship in response to economic change — that new jobs will be created to replace the old. While true in most respects, for individuals and communities buffeted by structural market forces beyond their control, "just let the market work" is neither an economically correct answer nor a response likely to win political favor.

Proponents of neoliberalism tend to overlook the politically salient pressures generated by the speed, irreversibility, and geographic concentration of market-induced changes. Their lack of empathy for working-class communities hollowed out by the competitive and technological disruption that took place between the 1980s and the early 2010s ceded the political lane to proponents of industrial policy, enabling Trump to ride the wave of working-class grievances to the White House in 2016.

The ensuing tariffs, along with President Biden's protectionist activity, invited retaliation from America's trading partners. A Federal Reserve study by economists Aaron Flaaen and Justin Pierce concluded that, contrary to protectionists' claims, employment losses triggered by trade retaliation were significantly greater than the number of jobs garnered through protectionism. The subsidy game tells a similar story: The Inflation Reduction Act's large incentives for domestic clean-energy projects put America's trading partners engaged in battery and electric-vehicle manufacturing at a disadvantage, which in turn pushed greater subsidization efforts overseas and prompted political grumbling among our trading partners.

It is policy failure, not a grand new economic strategy, that the Biden and Trump administrations' industrial policies have teed up. Market liberalism must rise once again to counter the muddled mercantilism of both. But instead of repeating the cycle of neoliberalism overcorrecting for central planning and vice versa, today's free-market and free-trade proponents will need to update their theories to address the challenges of our contemporary economy. By recovering insights from classical liberalism while keeping people in mind, economic policymakers can once again facilitate an open economy that ensures mass opportunity and flourishing.

MUDDLED MERCANTILISM

An intellectual path forward for today's economic liberals must begin by highlighting the practical failures of Sullivan's "new Washington consensus." To that end, it will be useful to revisit the lack of intellectual foundation in today's mercantilist industrial policy.

Skepticism of industrial policy revolves around two major challenges inherent to the strategy. The first is ensuring that capital is allocated to "winners" and not "losers." The second is protecting industrial policy from mission creep and rent seeking.

Hayek addressed the first problem in his classic 1945 article, "The Use of Knowledge in Society." As he observed there, "the knowledge of the particular circumstances of time and place" necessary to rationally plan an economy is distributed among innumerable individuals. No single person has access to all of this localized knowledge, which is not only infinite, but also constantly in flux. Statistical aggregates cannot account for it all, either. Thus, even the most earnest and sophisticated government planners could not amass the knowledge required to allocate capital to the right firms based on ever-changing circumstances on the ground. Recent examples of the government's misfires — from the bankruptcy of the federally subsidized solar-panel startup Solyndra to the billions in Covid-19 relief aid lost to fraud and waste — speak to the truth of Hayek's argument.

The free market, by contrast, transmits relevant information — that "knowledge of the particular circumstances of time and place" — in real time to everyone who needs it. It does so in large part via the price system. Friedman famously illustrated this process using the humble No. 2 pencil:

Suppose that, for whatever reason, there is an increased demand for lead pencils — perhaps because a baby boom increases school enrollment. Retail stores will find that they are selling more pencils. They will order more pencils from their wholesalers. The wholesalers will order more pencils from the manufacturers. The manufacturers will order more wood, more brass, more graphite — all the varied products used to make a pencil. In order to induce their suppliers to produce more of these items, they will have to offer higher prices for them. The higher prices will induce the suppliers to increase their work force to be able to meet the higher demand. To get more workers they will have to offer higher wages or better working conditions. In this way ripples spread out over ever widening circles, transmitting the information to people all over the world that there is a greater demand for pencils — or, to be more precise, for some product they are engaged in producing, for reasons they may not and need not know.

In this way, free markets ensure that capital is allocated to the right place at the right time based on the laws of supply and demand.

The second problem that plagues industrial policy arises when policies that are nominally targeted at a single goal end up serving the interests of government actors and individual firms. This problem comes in two flavors: mission creep and rent seeking.

Mission creep is the tendency of government actors to gradually expand the goal of a given policy beyond its original scope. One illustrative example comes from the CHIPS and Science Act, a bill designed to encourage semiconductor manufacturing in the United States. The act tasked the Commerce Department with drafting the conditions that manufacturers must meet to qualify for the program's $39 billion in subsidies. In addition to manufacturing semiconductors domestically, those rules now require subsidy recipients to offer workers affordable housing and child care, develop plans for hiring disadvantaged workers, and encourage mass-transit use among their workforces. While arguably laudable (and certainly attractive to various interest groups), these goals distract from the original purpose of the law and may even detract from it.

Rent seeking — another problem characteristic of industrial policy — is a strategy that firms employ to increase their profits without creating anything of value. They do so by attempting to influence public policy or manipulate economic conditions in their favor.

Rent seeking often arises when firms devote lobbying resources to garnering funds from new government largesse. For the CHIPS and Science Act, firms' scramble for subsidies replaces a focus on basic research. For the Inflation Reduction Act, firms' hiring consultants to help them gain access to agricultural-conservation spending and technical assistance replaces a focus on researching market trends.

Industrial unions — whose goals might not be consistent with market outcomes or the new industrial policy — are a second source of rent seeking. Today, both the left and right have slouched away from liberalism's emphasis on maintaining an open and dynamic labor market, pledging instead to create and protect "good jobs" — primarily in the manufacturing sector. This new thrust is yet another example of Washington picking "winners" and "losers" among industries and firms.

Concerns about this new approach to labor policy extend well beyond neoliberal critiques of limiting labor-market dynamism. Practically speaking, who decides what a "good job" is, or that manufacturing jobs are the ones to be prized and protected? Many of today's most desired jobs for labor-market entrants did not exist decades ago when manufacturing employment was at its peak. Why should industrial policy's goal be to cement the past as opposed to preparing individuals and locales for the work of the future?

A PATH FORWARD

Bidenomics' policy failures offer an opening for leaders on the right to champion a new type of liberal economics that avoids the pitfalls of both markets-only neoliberalism and industrial policy's central planning. In doing so, they will need to keep three things in mind.

The first is obvious but bears repeating: Markets don't always work well, and calls for intervention are not necessarily calls for industrial policy.

Critiques of neoliberalism often focus on the stark observation from Friedman's famous 1970 New York Times piece on the purpose of the corporation, which he asserted is to maximize its profits — full stop. While the article has now generated more than five decades of criticism, Friedman's argument is quite sensible as a starting point under the assumptions he had in mind: perfect competition in product and labor markets, and a government that does its job well — namely by providing public goods like education and defense, and correcting for externalities.

Put this way, the problem with neoliberalism is less that it is laissez-faire and more that it assumes away important questions about the state's role in the market economy. As a prominent example, national-security concerns raise questions about the boundaries between markets and the state. Export controls and certain supply-chain restrictions can be a legitimate way to deny sensitive technologies to adversaries (principally China in the present context). But they also raise several thorny questions. For instance, which technologies should be subject to controls and restrictions? What if those technologies are also employed for non-sensitive purposes? How do we defend sensitive technologies while avoiding blatant protectionism? (The Trump administration's invocation of "national security" in levying steel tariffs against Canada was less than convincing.) Economists should invite scientists and technology experts into these discussions rather than ceding all ground to politicians and Commerce Department officials.

A second lesson relates to competition — the linchpin of both neoliberalism and classical-liberal economics dating back to Adam Smith. Is the pursuit of competition, though a worthy goal, sufficient to ensure widespread flourishing?

Contemporary economic models assign value to economic growth, openness to globalization, and technological advance. But as noted above, with that growth, openness, and advance comes disruption, often in the form of a diminished ability to compete for new jobs and business opportunities. It's not a stretch to argue that a classical-liberal focus on free markets should also recognize the ability to compete as an important component to advancing competition. Competition might increase the size of the economic pie, but some will have easier access to a larger slice than others. Thus, in addition to promoting competition, today's free-market advocates need to focus on preparing individuals to reconnect to opportunity in a changing economy.

To that end, neoliberals would do well to increase public investment in education and skill training. This includes greater support for community colleges — the loci of much of the training and retraining efforts required to reconnect workers to the job market. The demand for such training is rising among young workers skeptical of the value of a four-year college degree: The Wall Street Journal recently reported that the "number of students enrolled in vocational-focused community colleges rose 16% last year to its highest level since the National Student Clearinghouse began tracking such data in 2018." Returning to Hayek's "Use of Knowledge" essay, these interventions are likely to be successful because they decentralize training programs, divvying them up to the educational institutions that are in the best position to prepare workers for the jobs of today and tomorrow.

A third lesson for today's neoliberals relates to the goals of the market. Smith, the father of modern economics, was also a student of moral philosophy — a discipline studiously avoided by most contemporary economists. To win the war of policy ideas, Smith understood that the goal could not simply be for the market to function. Today, demands to "let the market work" clearly do not meet the moment.

Market and trade liberalization are not ends in themselves; they are tools for organizing and promoting economic activity. Channeling Smith's thoughts in his other classic work emphasizing shared purpose, The Theory of Moral Sentiments, Columbia professor and Nobel laureate Edmund Phelps argued that economic policies should pursue freedom not for its own sake, but to facilitate "mass flourishing." In this vein, markets should promote, not prevent, innovation and productivity. They should aid, not hinder, the formation of strong families, communities, and religious and civic institutions.

Just as neoliberals need to be more cognizant of the human element in economics, proponents of industrial policy need to rethink the mercantilist strand present in their proposals.

To minimize the problems endemic to industrial policy — mission creep, rent seeking, and the risk of backing the wrong firms and industries — policy architects need to be both more general and more specific in their proposed interventions. By more general, I mean they must emphasize broad mechanisms to counter market failures. In the technology industry, for instance, expanding federal funding for basic scientific research can lead to useful applications for technologies and industries without picking winners and losers. Likewise, adopting a carbon tax would provide more neutral incentives for firms to develop low-carbon fuels and technologies without the need to pick winners and spend taxpayer dollars on costly subsidies. And again, as workers' skills are an important policy concern, increases in general public investment in education and training should be front and center in any industrial policy.

By more specific, I mean the proposed policy interventions must have more specific goals. The Trump administration's Operation Warp Speed succeeded without picking winners or over-relying on bureaucracy largely because its goals — developing and deploying a vaccine against Covid-19 as quickly as possible — were narrowly defined. Similarly, the Apollo program — which Senator Rubio rightly pointed to as an effective example of industrial policy — succeeded in part because it focused on a single, concrete, time-bound goal: putting a man on the moon within the decade.

Targeting and customizing aid is another way of making industrial-policy goals more specific. Economist Timothy Bartik has pushed for reforms to current place-based jobs policies, which typically consist of business-related tax and cash incentives. Such incentives, he argues, should be "more geographically targeted to distressed places," "more targeted at high-multiplier industries" like technology, more favorable to small businesses, and more "attuned to local conditions." Different local economies have different needs, from infrastructure to land development to job training. Funding customized services and inputs is more cost effective, more directly targeted at local shortcomings, and more likely to raise employment and productivity than one-size-fits-all tax and cash incentives.

While much of this analysis has been applied to the manufacturing context, such approaches can also be applied to the services sector. Customized input support would focus on developing partnerships between businesses and local educational institutions to develop job-specific training. Public support for applied research centers could help disseminate technological and organizational improvements to firms across the country. As with the general improvements to current industrial policy outlined above, these methods harness market mechanisms while recognizing and responding to underlying market failures.

A RIGHT TO OPPORTUNITY

The neoliberal notion that markets should focus on allocation and growth alone cannot be an endpoint; updating classical-liberal ideas with a deliberate focus on adaptation and the ability to compete is the place to start. Recognizing a right to opportunity in addition to property rights could provide a liberal counterweight to the temptation to reach for industrial policy to help distressed communities.

This right to opportunity — for today and tomorrow — should lead a conservative pushback to Bidenomics. Voters might not have much of a choice between Biden and Trump's economic populism in the election this fall, but economists and policymakers can begin to advance a new market economics that leaves no Americans behind in the hope that future administrations will take notice.