Financing Long-term Care

America's long-term care (LTC) system comprises services designed to meet individuals' health or personal-care needs when they can no longer perform everyday activities on their own. It is financed by a mixture of private but mostly public funds.

Given the nation's aging population and falling birth rate, the system is fiscally unsustainable. It's also unfair, riddled with bad incentives, and poorly administered — and matters are getting worse. By putting Medicaid back in its intended place and revitalizing private LTC insurance, we can help ensure that we are offering appropriate assistance to those who need it while putting our public LTC system on a path to fiscal sustainability.

RISK AND RESOURCES

LTC — sometimes called long-term services and supports, or LTSS — encompasses a range of health-related services offered to those who lack the capacity to care for themselves. LTC typically involves direct assistance or supervision over an extended length of time.

In contrast to acute-care services, LTC is not intended to treat a medical condition; rather, it is designed to assist those who require it with activities of daily living — walking, eating, bathing, etc. — in community or institutional settings. Examples of community-based assistance include home health and personal-care aides, adult day-care programs, and amenities offered in group homes or assisted-living facilities, such as meal preparation and laundering services. More intensive LTC is generally provided to those living in nursing homes or institutions for people with developmental disabilities.

Those planning for their later years confront a problem: They do not know whether and for how long they will require LTC. And if they do require it, they don't know whether unpaid assistance will be available or whether they will have to pay for care instead.

In the United States, family members and friends provide the bulk of LTC. But for some people, relatives are either unavailable or cannot provide the level and frequency of care required. For this reason, a significant portion of LTC in America is provided on a compensated basis, either by licensed professionals like nurses or, more commonly, by direct-care workers such as personal-care aides.

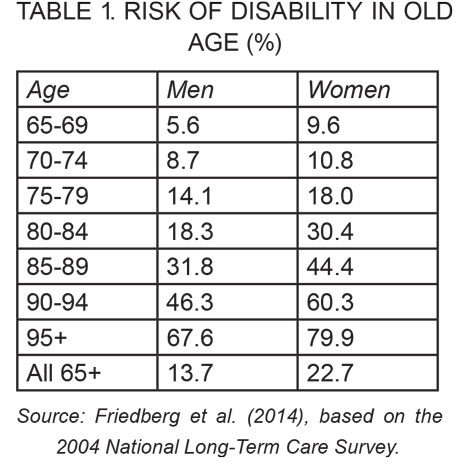

People of all ages can require LTC, but the risk increases rapidly with age for those over 65. As Table 1 shows, based on 2004 survey data, the percentage of individuals with some sort of disability increases from under 10% for those aged 65-69 to around 70% for those aged 95 and older. More recent statistics from a 2020 survey show broadly similar percentages. Other demographic factors influencing this risk include gender (the risk of needing LTC is nearly double for women relative to men) and race (blacks and Hispanics have nearly twice the risk of needing LTC relative to non-Hispanic whites).

Another way to measure one's risk of requiring LTC is on a lifetime basis. According to Richard Johnson of the Urban Institute and Judith Dey of the Office of Behavioral Health, Disability, and Aging Policy, around 56% of the U.S. population aged 65 and older can expect to be fairly severely disabled and need LTC at some point in their remaining years. Twelve percent of these individuals can expect that need to last under a year, while 22% can expect to have needs that last over five years.

As mentioned above, relatives bear much of the responsibility for LTC in the United States, and usually provide it on an unpaid basis. But not all individuals have family members available to provide LTC if the need arises; instead, they will have to pay for care. An estimated 45% of America's elderly population will require paid LTC — 24% for less than a year and 4% for more than five years, with the average duration lasting 0.8 years. If the current decline in the birth rate continues, we will likely see an increased need for paid care in the future.

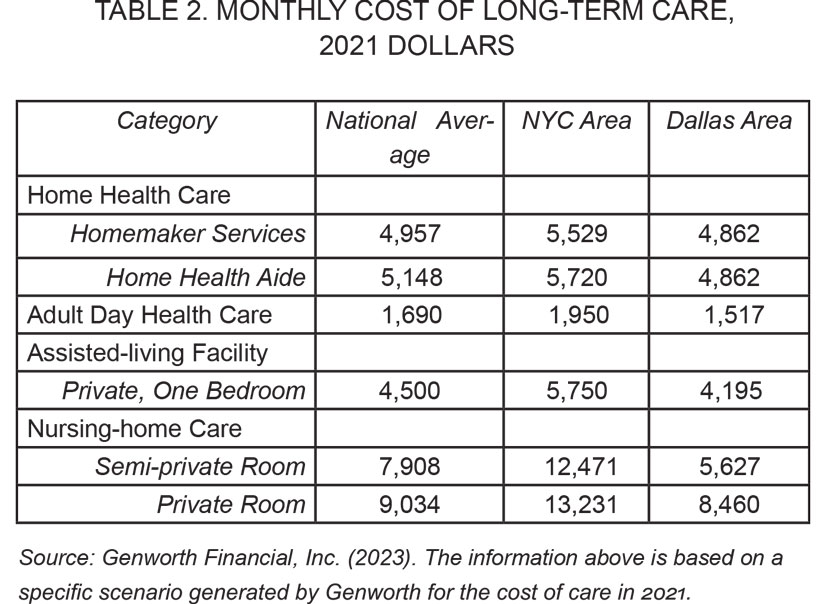

Paid LTC can be expensive. As Table 2 shows, the average cost in 2021 for a semi-private room at a nursing home was nearly $8,000 per month. For a home health aide working 44 hours per week, it was over $5,000 per month. These costs differ considerably based on location: Nursing-home costs in New York City are more than double those in Dallas, Texas.

Paid LTC is financed by a variety of public and private sources. According to Kirsten Colello of the Congressional Research Service, Medicaid and Medicare pay for about 44% and 20% of compensated LTC, respectively. Smaller federal programs pick up around 6% of the tab. The remaining 29% comes from private sources, including out-of-pocket spending at almost 14%, private insurance at 8%, and other private funding at 7%.

PROBLEMS WITH PUBLICLY FUNDED LTC

Medicaid — a government program that helps cover medical costs for people with limited income and assets — is the major source of funding for LTC in the United States. It pays for nursing-home stays, home health aides, and various other services. Though Medicaid is governed by a complex set of rules at the federal level, each state also designs and administers its own program, which can differ further at the county level.

Medicaid is jointly funded by the federal and state governments. In 2021, LTC accounted for 32% of all Medicaid spending. Sixty percent of this spending was devoted to various types of home-based care, while 40% went to institutional care.

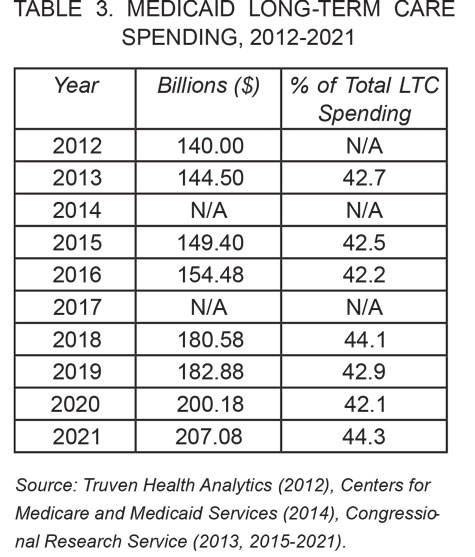

The amount taxpayers have spent on LTC through Medicaid has risen steadily over the past decade. As shown in Table 3, such spending increased about 4% annually, from $140 billion in 2012 to $207.1 billion in 2021. Medicaid has also gradually though unevenly taken on an increasing share of the nation's LTC costs over the past decade, from 42.7% in 2013 to as low as 42.1% in 2020 and as high as 44.3% in 2021. According to researchers at the Congressional Budget Office, in 2012, Medicaid spending on LTC for the elderly made up 1% of U.S. GDP.

Thanks to our aging population, the rise in Medicaid-funded LTC spending is not expected to taper off. Such spending is also projected to take up an increasing share of U.S. GDP. As the nation's population ages and care costs increase more rapidly than general prices, spending on LTC for those aged 65 and older is expected to triple its share of GDP by 2050. Total Medicaid-funded LTC spending will follow accordingly, putting additional pressure on state and federal budgets. Declining birth rates — meaning fewer children to assist their aging parents — will further increase the demand for paid care and, in turn, the burden on Medicaid, shifting public resources from those with children to those without.

Individuals in most states are eligible for Medicaid if their income and assets fall below the federal poverty level. Given these limits, many people believe the program offers LTC assistance only to impoverished individuals. Yet many studies have found that older households with middle- or even upper-middle permanent incomes use Medicaid-funded LTC without needing to spend down their assets to meet the program's requirements. How can this be?

It turns out that many states offer alternative paths to Medicaid eligibility. Most states give individuals access to institutional LTC through Medicaid if their income falls below 300% of the federal Supplemental Security Income (SSI) income limit. Most also have a separate "medically needy" eligibility criterion, whereby if one has to spend so much of his income on LTC costs that his leftover income is quite low (generally about half of the poverty level), he is eligible for Medicaid. If not for an asset test (more on this below), this latter provision alone would make many high-income individuals eligible for expensive nursing-home-based LTC through Medicaid. Indeed, due to spousal-income set-asides and exclusions, household income can be much higher — double the poverty level (which is in turn higher than the SSI limit) or more — and still allow a person to be eligible for Medicaid-funded LTC.

As noted, Medicaid eligibility also depends on an individual's accumulated assets, which often offer a better indicator of a person's ability to pay at older ages than income. To qualify for Medicaid-funded LTC, a person's accumulated assets are nominally limited to $2,000 for individuals and $3,000 for couples — the same as the SSI limits. However, many assets are not counted for Medicaid eligibility: These include household goods, income-producing businesses, some life insurance, automobiles, equity in a primary residence below a high value (no limit in California), some or all retirement assets, and a non-applicant spousal set-aside of $148,000. These exclusions make Medicaid coverage widely available to individuals with large asset holdings: And in fact, the 2022 Medicaid and CHIP Payment and Access Commission found significant asset holdings in the estates of deceased Medicaid recipients.

Households can also gain access to Medicaid-funded LTC by transferring countable assets to relatives. A 2005 federal law enhanced penalties for this practice, but the law is unevenly enforced. Current law also allows individuals to transfer some of their assets through techniques like Medicaid annuities (which convert an individual's cash assets into a monthly income stream), pooled trusts (through which an individual donates funds to a charity that invests those funds to earn dividends for itself and the donor's beneficiary), and, in California, significant daily transfers.

These large loopholes would matter less if states used liens on property to recoup government expenditures or recovered the assets remaining in the estates of deceased Medicaid recipients. Federal law requires states to use probate law to do the latter, but most states make little effort to do so. As it stands, states only recouped $700 million from recovered assets in 2020. California, the poster child of welfare laxity, recovered only $17 million in 2020 despite spending nearly $30 billion on Medicaid.

In sum, there are many opportunities for the better off to gain access to nominally means-tested Medicaid-funded LTC. This outcome may be due to a type of moral hazard — a problem that arises when individuals become more inclined to take risks when they have reason to believe that someone else, be it a public program or a private insurance firm, will cover the costs of any damages. In the case of Medicaid, public officials — perhaps looking to conserve enforcement resources and grant residents some flexibility — may be depending on resource-rich elderly populations to behave ethically in order to keep Medicaid focused on the poor. Yet as we have seen, the well-to-do tend to take advantage of the program nonetheless.

There is another type of moral hazard at play in the LTC system. When both public resources and private insurance are available, as is the case with LTC, individuals who may have relied on unpaid forms of LTC (perhaps from caring relatives or relatives anticipating a bequest) tend to switch to paid forms of LTC to ease the burden on family members. As basic risk statistics show, LTC allows considerable scope for this behavior, and research on home care supports the claim. This moral hazard causes insurers to offer less-than-full coverage of LTC risk, which they can achieve through co-pays, deductibles, and elimination periods tailored to the individual's level of resources and strict definitions of need.

Some states' Medicaid programs also suffer from what might be called "program creep": the increasing ease by which well-to-do individuals can access government-funded LTC ostensibly set aside for the poor.

California's Medicaid rules and practices offer a particularly obvious example. The state facilitates program creep by failing to include or enforce federal-law requirements in its own rules — a move we might consider wrongdoing by omission. In terms of commission, the state exacerbated the problem by requesting permission from regulators at the federal Centers for Medicare and Medicaid Services (CMS) to amend its Medicaid plan to expand eligibility by, among other steps, eliminating all asset tests. Incredibly, despite the contrary requirements of federal law and the resulting burden on all other federal taxpayers, CMS granted these requests. It did so without hearings or an opportunity for public comment, and strong evidence suggests that the cost score was lowballed.

Of course, what swings in one direction can presumably swing in the opposite direction. Tightening Medicaid's LTC-eligibility rules and administration would spur financial self-reliance among those with sufficient resources, thereby making Medicaid more sustainable. The same is true of taking more significant steps to encourage individuals to purchase private LTC insurance (LTCI), which will be discussed in the following section.

PROBLEMS WITH PRIVATE INSURANCE

The risk characteristics and cost of LTC would seem to make it a natural object for insurance coverage. And indeed, private LTCI is available, and is typically quite flexible, adapting to an individual's means and needs in terms of the amount of coverage purchased, the elimination period, the duration, and whether benefits will automatically increase at a fixed rate.

Yet private LTCI covers a relatively small portion of the country's LTC costs: Only about 11% of older Americans have LTCI. Although the product has existed in some form since the 1970s, sales of traditional stand-alone policies have stalled, and many leading companies have stopped offering them. (Sales of hybrid LTCI products — especially combined with life insurance — and voluntary employer offerings of hybrid coverage have expanded in recent years, however.) Meanwhile, premium rates for constant coverage have risen on both existing and new policies.

What accounts for the relatively light penetration of private LTCI?

The most prominent answer is that Medicaid crowds it out. Economists Jeffrey Brown and Amy Finkelstein offer strong logical and empirical evidence that this is the case for all but the higher income and wealth registers. According to their calculations, because Medicaid's benefits are free (even if partially means-tested), it is rational for all but those in the highest 10th to 35th percentiles of the wealth distribution to forgo purchasing private insurance. Put differently, Medicaid acts as an implicit tax exceeding 50% (and approaching 100%) of what one might expect to receive from an LTCI policy purchased today.

As a consequence, many potential policyholders would receive no net benefits from LTCI. For men at the median of the wealth distribution, Brown and Finkelstein estimate that 60% of the benefits they might receive from a private policy are redundant given potential Medicaid benefits. For women, the portion is 75%. The porousness of Medicaid's income and asset limits described above only increase the magnitude of these results. While we don't expect low-income households to purchase LTCI, middle-income households would likely purchase at least some level of coverage as part of their retirement planning if not for the Medicaid "tax."

This "tax" results from two factors. First, by protecting assets against large, unexpected expenses, private insurance reduces the likelihood that an individual will meet Medicaid's asset test. Second, when an individual has LTCI, Medicaid becomes a secondary payer, meaning that even if the individual meets Medicaid's income and asset limits, private insurance pays first. Medicaid would then cover any expenditures not covered by the private policy.

There are some small counterweights to the disincentive to purchase LTCI. In limited circumstances, premiums for qualified LTCI policies are deductible for federal income-tax purposes. This is the case if the individual has deductible medical expenses exceeding 10% of his income, or if the LTCI policy is paid for by the individual's employer — both relatively uncommon scenarios. Additionally, LTCI benefits are not considered taxable income at the federal level. In some states, purchasing LTCI gives the individual access to limited income-tax benefits in the form of credits or deductions.

Additionally, benefits from particular LTCI policies are not regarded as income or assets for determining Medicaid eligibility. They are also exempted from estate recovery by the state on a dollar-for-dollar basis. For example, if an individual's LTCI policy has a total benefit of $91,250 ($100 a day for 30 months), the law protects those assets, and that person would receive Medicaid coverage after he spends down his other assets. This is part of the LTC partnership program — a joint federal-state policy initiative designed to prevent individuals from having to become impoverished to qualify for Medicaid.

The partnership program is available in nearly all states on a portable basis (i.e., not tied to one's initial residence when purchasing coverage). Because wealthy people generally do not need to purchase LTCI, the program is intended to target middle-class customers who want to acquire front-end private and catastrophic public-insurance protection and still leave a bequest to their children or to charity.

Federal law requires partnership LTCI policies to automatically increase coverage according to inflation. This inflation-protection mechanism increases the cost of the LTCI policy and raises the insurer's exposure to risk.

The partnership program's incentives appear to have an impact on consumers' likelihood of purchasing LTCI. In 2018, Brown University's Portia Cornell and Harvard University's David Grabowski found that the presence of a state tax incentive increases LTCI participation among those aged 50-69 who can pass the underwriting criterion by 30%. The LTC partnership program increases it further, by 18%.

These are statistically and economically significant effects. But does the partnership program actually save Medicaid money?

The answer to this question depends on whether individuals would have purchased LTCI without the tax and partnership incentives. It also depends on the cost of these incentives in the form of forgone tax revenue and increased Medicaid expenditures. A 2007 study by AHIP — an advocacy and trade association for certain health-insurance companies — claims that the partnership program can save the federal government $6 billion annually in 2005 dollars. Most academic studies, however, are inconclusive.

According to Mark Meiners, president of the Long-Term Care Educational Foundation, this is because their models ignore the central issue described above: the fact that middle-income, upper-middle-income, and upper-income individuals use Medicaid-funded LTC through asset transfers, porous income- and asset-eligibility rules, and lack of estate recovery. Consequently, they have relatively little incentive to purchase LTCI ab initio. But it is certainly possible that, even under Medicaid's current rules and administration, some moral hazard can be avoided if individuals feel better about purchasing LTCI. This possibility would be greater if regulators raised the current modest incentives for LTCI and blocked the pathways to Medicaid coverage for those with significant income and assets.

Aside from Medicaid's crowd-out effect, there are other reasons for the relatively low penetration of LTCI among the older population. As a traditional stand-alone product, LTCI suffers from several problems, the first of which is adverse selection. When individuals have more information about their risk of requiring LTC than the insurer pricing and designing the insurance product, there is a tendency for those more likely to claim benefits — such as people in poor health or those who are already disabled — to be more willing to purchase insurance, while those in good health will avoid purchasing insurance unless they are highly risk averse. This raises premiums for everyone and might even lead to market failure.

To avoid the latter outcome, insurers evaluate applicants' medical histories, which enables them to price insurance policies based on the individual's observable risk characteristics. Such underwriting has always been performed for LTCI sold directly to individuals, but not for LTCI provided through employers and less often for hybrid products.

LTCI also commonly uses a level-periodic premium structure, which creates further incentives for individuals to separate into different risk pools according to observable characteristics. Under level-periodic premium policies, monthly, quarterly, or semi-annual premiums remain the same throughout the policy holder's life. The alternative is a single-premium policy, whereby the policy holder pays a lump sum up front in exchange for a guaranteed benefit.

Level-periodic premium policies tend to collect more money from healthier purchasers because these individuals usually have longer life expectancies than the less healthy. As a result, insurers will charge healthier individuals lower premiums than they would charge them under a single-premium product design. Those in lesser health, meanwhile, will be charged more, or even excluded from purchasing policies entirely. In fact, under LTCI's current level-periodic premium structure, according to research by this author and his co-author Jason Brown, who was then at the Treasury Department, at least 20% of 65-year-olds (and more at older ages) would be rejected by underwriting. Only 3% would be rejected under a single-premium structure.

LTCI's level-periodic premium structure also makes it subject to lapses in premium payments. This is mainly due to liquidity issues that arise for individuals as they age. Those who drop their policies before reaching the ages when making a claim becomes more likely lose out on the benefits they might have received if they could afford to continue paying the premiums. Ironically, policy lapses under the level-periodic premium approach make the coverage cheaper for those who are not constrained by liquidity — typically those with high lifetime incomes, who are more likely to be in good health at initial purchase than middle-income purchasers.

When LTCI was first introduced, the level-periodic premium structure made sense. At the time, insurers were uncertain of the true costs of the new product and didn't want to guarantee prices for the potentially several-decade-long life of a policy, especially with the need to index for inflation. Periodic premiums allowed insurers (subject to the permission of state insurance commissioners) to raise premium levels or reduce benefit levels for current policyholders if claims were higher or the number of lapses were lower than expected — as indeed transpired. But the actual repeated, sizeable premium increases and benefit cutbacks that occurred, which violated the intention of holding premiums level, harmed the product's reputation.

LTCI is now a mature product that actuaries should be able to price correctly and stably. They should also be able to hedge various risks, like changing interest rates, through the futures market and other investment techniques.

Regulatory disadvantages also weigh heavily on private LTCI. In a few states, premiums must be unisex for individual policies, as they must be for group benefits from employers under federal law. This requirement reduces the incentive for men to purchase LTCI given their lower risk of needing LTC compared to women. The complex and disparate state-based regulation of insurance adds to the administrative and marketing costs of private LTCI.

In sum, the substantial crowd out by Medicaid, the underwriting of LTCI at older ages, various regulatory burdens, and LTCI's bad reputation due to premium increases have limited the private LTCI market. The current tax and partnership incentives are no match for these countervailing factors.

PAST AND PROPOSED SOLUTIONS

Given the well-known and longstanding problems with current public and private LTCI schemes, lawmakers have attempted to address the situation — mainly by expanding the government's role in LTC.

The first move occurred in 1988, when Congress passed the bipartisan Medicare Catastrophic Coverage Act. The act expanded Medicare's coverage of LTC by extending the 100-day limit on nursing-home care to 150 days and introducing a small home-care benefit. It also called for research on a fuller LTC social-insurance program. The following year, however, Congress was forced to retract the law owing to the unpopularity of its funding mechanism: additional income-related Medicare premiums on the elderly.

The next major attempt came in 2010 with the passage of the Affordable Care Act (ACA). The law would have set up a publicly administered LTCI program called Community Living Assistance Services and Supports (CLASS). Those participating in the program would have received modest, inflation-indexed cash benefits over their lifetimes to help cover the costs of LTC in exchange for paying premiums during their healthy working years. Though CLASS was nominally voluntary, individuals of participating employers would have been automatically signed up unless they opted out. The law prohibited exclusion from CLASS based on health status or preexisting conditions, meaning the program was in essence selling insurance policies with no underwriting.

Because of the extensive cross-subsidizations within the program — including from the healthy to the disabled, men to women, and full time to part-time, transient, and low-income workers and students — there would have been considerable adverse selection, eventually resulting in what's known as a "death spiral" whereby the program would prove unsustainable and require a federal bailout. At the same time, the relatively easy path to gain cash benefits once a person became disabled would have created moral hazard and led to even higher costs. Although Medicaid would have saved some money because of its continued secondary-payer status, those savings would have been limited because only 50% of home-care benefits would have been paid to Medicaid for those it covered.

With all these problems known in advance, why was CLASS included in the ACA? It turns out that policymakers designed the program so that participants would have to pay premiums for five years before coverage was available. Thus, the Congressional Budget Office scored CLASS as raising substantial revenues for years before its cash flow turned negative. Indeed, CLASS became a significant source of funds to pay for the ACA, helping confirm President Barack Obama's claim that the legislation was "paid for." In 2011, however, the Obama administration determined that CLASS was not workable, and in 2013, Congress repealed it.

There have been perennial calls for policymakers to create a social-insurance program financed by payroll taxes to cover LTC. Many sponsored studies and analyses have been conducted to design and determine the cost of various proposals. But these ideas have not gotten much traction in the face of opposition to increased taxes. Other problems with these proposals include the modest level of benefits suggested for the start of the programs, concerns that initial cost estimates were significantly understated, and the unfair distributional impact (the poor, already covered by Medicaid, would pay increased taxes, while the well-to-do would receive new benefits). One suspects that, as with Medicare, benefits and costs would expand over time without being fully scored or financed, all at a time of record federal deficits and debts and the impending insolvencies of the existing federal social-insurance programs, Social Security and Medicare.

Due to these practical and political hurdles, advocates of an expanded government role in LTC financing have turned to the states, where they have met with some success. California, as noted above, has chosen to expand Medicaid eligibility while loosening its enforcement of asset-transfer and estate-recovery rules. Meanwhile Washington state, after a delayed start and opposition from local Republicans, created a social-insurance LTC program called WA Cares in 2019.

Under WA Cares, a Washington state resident who is either cognitively impaired or needs assistance with three activities of daily living can receive modest lifetime inflation-indexed indemnity benefits after a short elimination period. The program is financed by a payroll tax set at 0.58% of workers' wages (with no cap) for all employees of Washington-state companies who work more than 500 hours a year. Those employees who attested (with no verification from the state) before December 31, 2022, that they had private LTCI in 2021 were exempted from the tax.

The program appears to be deeply unpopular. Nearly 475,000 Washington workers (about an eighth of the employees in the state) claimed they had private LTCI and were thereby exempted from the tax. Data show that these exempt workers included mainly high-salary workers, and many of them were young — circumstances that hurt the program's solvency. What's more, insurance-company surveys indicate that only around half (at most) of those claiming exemptions had actually purchased LTCI of any sort. Those who did purchase LTCI will likely let their coverage lapse over time, given that there's no requirement for continued coverage to maintain exemption from the payroll tax.

WA Cares also grants significant leeway for Washingtonians to opt into or out of the program regardless of whether they have LTCI. For instance, self-employed individuals may opt into the program on a voluntary basis. Indian tribes, on behalf of their members, can opt in or out at any time. Non-residents of the state employed by a Washington-based firm are fully exempt.

WA Cares bears many similarities to CLASS, including serious concerns about future deficits and the program's long-term solvency. The adverse distributional effect is also the same — low-income workers in Washington pay taxes for benefits that replace the Medicaid benefits they might have received for free. And like any state social-insurance program, WA Cares is unfair to workers who move out of the state to retire, who end up paying a lifetime of taxes but receiving no benefit.

After a pause and a class-action lawsuit, Washington started collecting payroll taxes to fund WA Cares in July 2023. But the long-term actuarial and political viability of the program is in doubt. Indeed, there will be a state-ballot question in November 2024 about whether the program should be made voluntary, and it is expected to pass. Astonishingly, California — at a time of massive budget deficits, high unemployment, and business-tax increases — is exploring a similar state social-insurance program.

THE WAY FORWARD

LTC reform efforts should aim to offer appropriate assistance to those who need it and expect self-reliance from those who can afford it. Ideally, any changes made would rely on current institutions and laws, and would control government spending. To succeed, such reforms will need to involve three steps: refocusing Medicaid on the poor, enhancing the partnership program, and revitalizing private insurance.

The fact that basic Medicaid coverage of LTC is so widely available eliminates most individuals' incentive for self-reliance. Various regulatory loopholes, lack of state enforcement at the eligibility-determination and estate-recovery stages, and expansion of asset-limit exemptions make matters worse, allowing even wealthy individuals to gain Medicaid-funded LTC benefits. No progress can be made unless policymakers address this problem directly.

Both economic logic and empirical evidence show that vigorously enforced and well-advertised Medicaid eligibility rules and estate-recovery efforts increase middle-income and wealthier individuals' incentive to either purchase LTCI or save for the possibility of requiring LTC rather than relying on Medicaid for their LTC needs. Lawmakers should thus begin their LTC reforms by targeting these policy areas.

In terms of Medicaid eligibility rules, CMS's administration of federal Medicaid law should be made consistent so that in every state, all retirement assets in the household are countable after an individual reaches age 59-and-a-half (when plan and account distributions are no longer subject to a penalty tax). At the same time, policymakers should prohibit asset-transfer mechanisms like Medicaid annuities and pooled trusts, which would help prevent people from transferring their assets to meet Medicaid's asset tests.

As for the estate-recovery stage, the federal government needs to start enforcing its law requiring states to recover assets from the estates of deceased Medicaid recipients. Full estate recovery would cover most of the costs of the high-value asset exemption for a recipient's primary residence with limited negative consequences. Even a modest improvement in state efforts at estate recovery, combined with the universal regard of retirement assets as countable, would increase the resources available to Medicaid by nine-fold, to $6.2 billion annually.

To spur state action, federal law should impose on all states goals for modest but increasing recoveries as a percentage of the estimated net worth of deceased Medicaid-funded LTC beneficiaries over the age of 55. To hold states accountable, the federal government should gradually reduce its matching share of a state's Medicaid funding until the state complies with these goals.

Given its massive population, generous Medicaid-eligibility rules, and failure to recover expenditures from deceased Medicaid recipients, the state of California poses a distinct threat to Medicaid's sustainability. Federal policymakers hoping to avoid fiscal deterioration must bring the state into compliance with federal law. This would involve imposing stricter asset-transfer rules, much lower assets limits, and a limit on housing equity value in determining Medicaid eligibility. Federal policymakers should direct California to implement these changes and hold the state accountable in the manner described above.

Taken together, these changes would slow the rate of increase in federal- and state-government spending on Medicaid. More favorable federal tax treatment of LTCI would also help matters, but this would require a change in tax law and a loss of tax revenue, making it unlikely to occur soon. We must therefore use tools within CMS's existing authority to approve changes made through state-plan amendments.

As seen in California's case, CMS's discretionary authority on this front appears to be quite broad. Policymakers should take advantage of this by increasing the LTCI partnership asset offset for single-premium policies from a dollar-for-dollar to a two-dollars-for-dollar basis. In the example given above — “if an individual's LTCI policy has a total benefit of $91,250 ($100 a day for 30 months)” — $182,500 would be protected from estate recovery. Of course, this change would be most effective when combined with the Medicaid-reform recommendations listed above, many of which could also be included in a state-plan amendment or demonstration project, or otherwise enforced by CMS.

Policymakers must also address current requirements for LTCI coverage under the partnership program to help revitalize the LTCI market. In particular, only single-premium, gender-distinct LTCI policies, or those combined with a life annuity, should be allowed access to the enhanced (double-offset) partnership treatment. Other LTCI products should continue to be eligible for the current single-offset treatment.

As noted above, single-premium policies are not subject to lapse risk and encourage the market to stabilize. They require only limited underwriting to exclude those who will immediately claim benefits, and are therefore available to many more people at retirement ages than traditional stand-alone policies with level-periodic premiums. Although inflation-indexation is generally desirable, it adds to the insurer's risk and costs to the insured, especially in the context of a single-premium policy, so it's best that this requirement be removed. As is true today, the benefit levels, duration, offer ages, and benefit triggers would not be specified beyond current tax-law requirements, allowing insurers to experiment with new products to meet consumer demands and preferences.

Policies with fairly long elimination periods will likely prove most economical and therefore most popular. The payment of single premiums could be financed through 401(k) or IRA balances, or from the proceeds of a reverse mortgage or home-equity line of credit. A single-premium policy cannot be canceled, so subsequent benefit cuts or premium supplements would be prohibited: Insurers will have to bear the risk of their pricing and policy design.

To be effective, these changes must be publicized. Although we can expect insurance agents and financial planners to explain the new package of incentives and disincentives to their clients, states themselves should also advertise the changes — perhaps by asking the Social Security Administration to send information booklets to residents claiming Social Security retirement benefits explaining how Medicaid and the partnership program work under the new system.

STRIVING FOR SUSTAINABILITY

The current public-policy and market equilibrium in LTC is not stable. And despite the long-run budget hit and a looming fiscal crisis, that equilibrium is drifting toward greater government involvement and funding. We must actively point out problems with new proposals for government expansion while also developing thoughtful private-sector and public-policy solutions to existing problems. Ultimately, we will need to design and adopt fairer, more sustainable policies that secure better outcomes for current and future generations of older Americans.