The Cost of Illegal Immigration

The chaos at the border in recent years, along with even Democrat-run cities complaining about its impact, have cast into stark relief one of the central issues surrounding illegal immigration: its fiscal costs. Unfortunately, most discussions on the subject tend to be filled with misconceptions, half-truths, and at times even outright falsehoods. A fair read of the evidence indicates that illegal immigrants are almost certainly a net fiscal drain, but not because they are illegal per se. Nor is it because they are freeloaders or welfare cheats, or because they don't pay any taxes.

The reason is that a very large share of illegal immigrants have modest levels of education, which results in modest incomes and tax payments, even when they are paid on the books. Their generally low incomes also allow many of them to qualify for means-tested welfare programs, which they often receive on behalf of native-born children. In other words, illegal immigrants are a net fiscal drain on public budgets for the same reasons that legal immigrants and native-born Americans with low levels of education are: They receive more in benefits from the system than they pay into it.

These realities do not neatly satisfy either side of the contemporary immigration divide, so they are routinely ignored or even denied. Any serious and informed immigration-policy debate will have to confront them.

THE ILLEGAL-IMMIGRANT POPULATION

Whatever the fiscal impact of the average illegal immigrant, it would not matter much if there were relatively few in the country. But the illegal-immigrant population has been large for decades. We can arrive at reasonable estimates of that population primarily because, contrary to what is sometimes asserted, illegal immigrants do not live in the shadows.

It's not just that illegal immigrants have appeared at press conferences with sympathetic politicians or prominent activists: The Census Bureau makes it clear that illegal immigrants respond to the decennial census and its various surveys. The Bureau of Labor Statistics, which uses census surveys, is also clear on this point. Numerous researchers over the last four decades have used data from these two agencies to study illegal immigrants living in the United States.

Much of the pioneering work in this area was performed by Robert Warren — formerly at the Immigration and Naturalization Service and now at the Center for Migration Studies — and Jeffrey Passel at the Pew Research Center. In the 1980s, both Warren and Passel realized that they could estimate the number of illegal immigrants residing in the country through census data. Since researchers can discern the characteristics of immigrants in the country legally based on administrative data, by comparing their survey profile to the characteristics of the entire foreign-born population, they can figure out who the likely illegal immigrants are. This basic insight allows us to study illegal immigrants in a systematic way.

Prior to the border-crossing surge during the Biden administration, analysis of Census Bureau data showed roughly 10 or 11 million illegal immigrants in the United States. When adjusted for undercount, it produced estimates of 10 to 12 million. This does not include the roughly 5 million native-born minor children of illegal immigrants who were all awarded American citizenship at birth.

Many Americans doubt the number was this "low," or that it remained relatively constant before the Covid-19 pandemic. It's certainly true that hundreds of thousands of new illegal immigrants crossed the border surreptitiously or overstayed a temporary visa every year before the pandemic, even during the Trump administration. But their numbers were offset by all those who left on their own, were deported, died, or gained legal status (e.g., by being granted asylum or marrying an American citizen) every year. Warren estimates that between 2010 and 2019, 5.9 million illegal immigrants left the illegal population in various ways.

Another likely reason that Americans believe the illegal-immigrant population is larger than those estimates suggest is that they underestimate the number of legal immigrants allowed into the country. Despite out-migration and natural mortality, the legal-immigrant population has roughly tripled in size since 1980. To the extent that the media report on legal immigration, they often leave the public with the impression that it is highly restrictive. This leads many Americans to assume that the huge increase in the foreign-born population they see around them must be due to illegal immigration.

While we can be reasonably certain that the pre-pandemic estimates of illegal immigration were accurate, there is not an absolute consensus. In 2018, several researchers at Yale University published an article purporting to show that the illegal-immigrant population was closer to 22 million. Most demographers, myself included, find that number implausible, as it would mean that something like 11 million illegal immigrants are missing from the Census Bureau data (which include the annual American Community Survey and the monthly Current Population Survey). When the bureau re-canvasses neighborhoods after each decennial census, it does not find an undercount anywhere near that large. Moreover, when we compare birth, death, and school-enrollment data to what the Census Bureau surveys show, we see no evidence that an enormous number of individuals are going uncounted. Such a large population could not live in the United States without leaving some administrative record of its presence.

THE COSTS OF ILLEGAL IMMIGRATION

Government surveys collect demographic data of all kinds, including U.S. residents' place of birth, citizenship status, year of arrival, occupation, income, education level, and use of government benefits. These surveys provide data for published reports on everything from the unemployment and poverty rates to median household income and the share of U.S. residents without health insurance. Surveys aren't perfect, of course, but the information they gather allows us to learn much about the illegal immigrants living in the United States.

The profile of the illegal-immigrant population that emerges from Census Bureau surveys is not surprising: It shows a population that is primarily from Latin America, under the age of 65, and disproportionately male. These immigrants are concentrated in such sectors as agriculture, construction, building cleaning and maintenance, light manufacturing, and food service and preparation. They also tend to be modestly educated.

The best predictor of a person's fiscal impact is educational attainment, which influences both their occupation and their resulting income. Income matters enormously when calculating the costs of illegal immigration because it affects both tax payments and eligibility for means-tested anti-poverty benefits. The Migration Policy Institute and the Center for Migration Studies estimate that about 70% of illegal immigrants have no education beyond high school, which is double the share of the native-born population. Both organizations also estimate that only about 18% have a bachelor's degree, which is half the rate of the native born.

Most illegal immigrants received their education outside of the United States — typically in Latin America, where education systems face significant challenges and students score quite low on tests of basic skills. Adult immigrants to the United States from the region also tend to struggle on tests that measure literacy and math skills. Thus, it is not surprising that illegal immigrants residing in the United States earn modest wages.

Given that illegal immigrants tend to be low-wage workers, we can get a better sense of their fiscal costs by looking at the welfare system. Illegal immigrants, as well as most new legal immigrants, are technically barred from participating in most welfare programs directly. Numerous media outlets have emphasized this point over the years to assure the public that there is no reason for concern. That bar, however, is much less meaningful than they realize.

In a study published in December, my colleague Karen Zeigler and I examined welfare use in the Survey of Income and Program Participation (SIPP), which the Census Bureau describes as "the premier source of information" on "program participation." We looked at the major cash, food, and housing programs, along with Medicaid. Use of these programs is an important indicator of fiscal impact not only because the programs themselves are costly, but because those receiving them generally pay little to no income tax.

We estimate that 59% of households headed by an illegal immigrant use one or more of these welfare programs, compared to 39% of native-headed households. Illegal-immigrant households make especially high use of the Earned Income Tax Credit (EITC); the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); free or reduced-price school meals; Medicaid; and food stamps. We estimate that this population costs these programs roughly $42 billion annually.

To be clear, the vast majority of illegal-immigrant households receiving welfare have at least one working member. But work in no way precludes use of the welfare system if one's income is low enough, which it is often the case for illegal immigrants.

How do so many illegal-immigrant households access the welfare system?

Despite the general bar on their receipt of welfare benefits, illegal immigrants are directly eligible for certain programs, and much of the welfare bureaucracy is dedicated to helping low-income immigrants sign up for the programs for which they are eligible. In a majority of states, low-income pregnant women can enroll in Medicaid regardless of their legal status. Many states also offer Medicaid, and a few give food stamps, to illegal immigrants residing within their borders. Illegal-immigrant children can receive some benefits directly — primarily free or subsidized school meals and WIC. Meanwhile, illegal-immigrant parents can participate in virtually every public welfare program on behalf of their native-born children. Given that over half of illegal-immigrant households include a child who is an American citizen, this amounts to a substantial number of beneficiaries.

What's more, several million illegal immigrants — including those with deferred action from deportation, Temporary Protected Status, and many pending asylum applications — have work-authorization permits and Social Security numbers, which allow them to receive the EITC. A family of four earning $36,000 in 2023 would pay no federal income tax; instead, it would receive a payment of just under $5,000 through the EITC.

This points to a fundamental dilemma for those who want to bring in workers to fill low-skill jobs: Such workers may help increase employer profits and reduce consumer prices, but they create broader costs for society. Some argue that we can allow these workers to remain in the United States but bar them from using the welfare system. Illegal immigrants' current use of welfare programs and other public services shows why, both practically and politically speaking, this would be next to impossible.

There is an alternative way to fill low-skill jobs — namely by drawing more Americans back into the labor force. The share of less-educated native-born men who have abandoned the labor force (i.e., they are neither working nor looking for work) has increased dramatically over the last six decades. In 1960, 7% of native-born men ages 20 to 64 with no education beyond high school were out of the labor force; in 2023, it was 22%. These individuals do not show up as unemployed in labor statistics because they are not actively looking for work. This deterioration in labor-force participation, powerfully chronicled in Nicholas Eberstadt's Men Without Work, is associated with a host of social pathologies, from drug overdoses to crime.

Unlike allowing employers to rely on illegal-immigrant labor to fill low-skill jobs, encouraging these out-of-work Americans to join the workforce would not create new fiscal costs. In fact, it could even save taxpayers money while creating a virtuous cycle to address native-born men's abandonment of work. As more Americans acquire jobs, they would reduce the nation's welfare expenditures while also putting upward pressure on wages at the bottom of the labor market. This, in turn, might help draw even more Americans back into the workforce.

The high welfare use by immigrant households, both legal and illegal, is a well-known finding. Immigration advocates sometimes respond by pointing out that low-income immigrants, including illegal immigrants, are no more likely to use welfare than low-income native-born Americans. While often true, this argument obscures the fact that immigrants are much more likely to be low income in the first place.

Advocates also assert that Social Security and Medicare are really welfare programs, and that there is not much of a difference between immigrant and native-born welfare use when they are included. But Social Security and Medicare are not means-tested anti-poverty programs; they are social-insurance programs that require participants to pay into them before getting something out.

Since much of the welfare going to illegal-immigrant households is targeted at their native-born children, some argue that this constitutes welfare use by natives rather than immigrants. But parents are legally and morally obligated to provide their children with basic necessities. When the government steps in to do that for them, the parents benefit. In any case, the costs of welfare for the native-born children of illegal immigrants would not exist if the parents were not in the country. It is thus disingenuous to argue that these welfare costs are not a direct result of illegal immigration.

Aside from welfare, public education is probably the largest single cost associated with illegal immigration. Based on estimates developed by Pew and my own analysis, about 4 million children of illegal immigrants attended public school before the pandemic, the vast majority of whom were native born. Conservatively, the cost to educate these children amounts to $68 billion annually, with many of the most affected school districts already struggling to educate at-risk students.

Medical treatment for the uninsured is another area where illegal immigrants generate significant costs — around $7 billion annually before the Covid-19 pandemic. The waves of illegal immigrants that have arrived since the pandemic have stretched emergency rooms and public clinics in some cities to the breaking point.

Of course, there are other costs associated with illegal immigration. These include the costs of police and fire protection, incarceration costs, and the impact additional residents have on infrastructure. But welfare, education, and health care are the most significant.

TAX REVENUE AND ECONOMIC IMPACT

Like the misconception that illegal immigrants do not use welfare, the notion that they do not pay taxes is also mistaken.

To begin, everyone, regardless of legal status, pays sales taxes and user fees. Those who rent their residence probably pay some property taxes indirectly. Additionally, as mentioned above, many illegal immigrants have valid Social Security numbers and work-authorization permits, while others have stolen or otherwise forged the documents they provide to employers. Reasonable estimates suggest that 55% of illegal immigrants are paid "on the books." I estimate that in 2019, illegal immigrants paid $5.9 billion in federal income tax, $16.2 billion in Social Security taxes, and $3.8 billion in Medicare taxes (including employer contributions).

So illegal immigrants do pay taxes — to the tune of $25.9 billion to the federal government alone. But the tax revenue they generate does not come close to covering their cost: Even though illegal immigrants make up about 4.5% of the labor force, their payments represent less than 1% of the taxes collected from these sources.

In 2017, the National Academies of Sciences, Engineering, and Medicine conducted a study to project immigrants' lifetime fiscal impact on the United States. Unfortunately, the study does not report separate estimates for illegal and legal immigrants; it simply estimates tax payments and government expenditures on all immigrants based primarily on the Annual Social and Economic Supplement to the Current Population Survey, then subtracts the value of the services used from the taxes paid to find the net impact.

Still, we can use this data to get a rough estimate of illegal immigrants' lifetime fiscal costs versus contributions. If we take the averages of the scenarios in the National Academies' study, adjust for legal status, and apply the education level of illegal immigrants, we end up with a lifetime net fiscal drain of $68,390 in 2023 dollars for each illegal immigrant residing in the country.

There are some caveats about estimates of this kind, including the fact that these data were not originally gathered to study the illegal-immigrant population. Moreover, the long-term fiscal situation in the United States has deteriorated since the National Academies developed its fiscal projections, meaning the fiscal impact of the less-educated (as well as the average taxpayer) has become somewhat more negative. All that said, the fiscal analysis does tell us that illegal immigrants do not typically pay enough in taxes during their lifetimes to cover their consumption of public services.

When Social Security and Medicare are considered separately, illegal immigrants are a net positive: They pay into the system without taking any benefits out. However, they must remain illegal to continue having such an impact; if they were legalized and allowed to receive benefits under the programs' progressive benefit structures, their net effect would turn negative. It is simply not possible to improve the long-term outlook for retirement programs by adding low-wage workers to the system unless they remain illegal or ineligible — a path that would prove difficult to pursue politically.

Having worked on this issue for almost 30 years, I can report that, whenever the fiscal costs of illegal immigrants are discussed, I invariably hear that they contribute much more to the economy than they use in services. This is often not a reference to taxes they might pay, but to their larger contribution to productivity and output.

More workers in the country certainly means more economic activity. Indeed, given their labor incomes, the U.S. economy is roughly $300 billion larger due to illegal immigrants. On its face this is certainly a large number, but it represents less than 2% of GDP.

The deeper problem with this argument is that enlarging the economy is not the same as enriching Americans. Almost all the value from the increase in economic activity goes to the illegal immigrants themselves in the form of wages and benefits (as it should, since they are the ones doing the work). The standard of living in a country is determined not by the overall size of the economy, but by per capita GDP. If all that mattered were GDP, India would be considered much richer than Sweden because India's economy is much larger. Fiscally, what matters is the taxes the newcomers pay and the services they use. And for illegal immigrants, the difference between them is decidedly negative.

THE BORDER SURGE

Prior to the Covid-19 pandemic, we had a reasonable picture of illegal immigrants in the United States and their fiscal impact. But since President Biden took office, the flow of illegal immigrants into the country has been nothing short of astonishing. The 9.6 million "encounters" at U.S. borders from January 2021 to April 2024 receive the bulk of the attention. This number is less important than it might seem because it includes multiple crossing attempts by the same individuals. Still, the number of people the administration has purposefully released into the country is enormous.

Information obtained by Congress and others shows the administration has taken into custody and then released into the United States some 3.6 million illegal immigrants. It may seem strange, but technically almost all of these individuals have not actually been formally "admitted"; they are considered "inadmissible aliens," which means that they have no visa, border-crossing card, or other legal means to enter the country but are allowed in anyway. All are (or will be) subject to deportation, though the Department of Homeland Security (DHS) will ultimately choose whether to act.

The DHS secretary has the authority to allow non-citizens to enter the United States on a temporary basis for "urgent humanitarian reasons" or because they will create a "significant public benefit" for the country. Roughly half of inadmissible aliens have been granted parole under these rules. While the DHS website is clear that parole is not designed to "avoid normal visa processing procedures" or "replace established refugee processing channels," that is exactly what has been happening: The administration is using the program in a way never before contemplated.

Others who are released after crossing the border are asylum applicants. Many are granted entry without a "credible fear" interview — which is supposed to weed out frivolous asylum claims — because the whole system is so overwhelmed. The immigration courts are so backed up that many of those released are given court dates many years in the future. It will take at least a decade to work through the backlog that exists today.

In addition to those released into the country, there have been at least 1.7 million "got-aways" — individuals detected entering illegally but not stopped — at the border since the start of the Biden administration. This is several times the pre-pandemic annual rate and does not include all those who made it past the Border Patrol without being detected. Additionally, there was a record number of visa overstayers (e.g. tourists, foreign students, and guest workers) in 2022. We do not know how many of these individuals stayed long term, but whatever their number, they too represent new additions to the illegal-immigrant population.

All told, during the first three years of the Biden administration, 6 to 7 million new illegal immigrants likely settled in the United States. We have never seen anything like this before.

How did this happen?

A big reason why so many people started showing up at the border at the end of 2020 was Biden's campaign promise to get rid of Trump-era immigration policies. Chief among these policies were the Migrant Protection Protocols (colloquially known as the "Remain in Mexico" policy), which began in 2019 following a spike in asylum applicants. Since the vast majority of those applying for asylum wished to simply be released into the United States, requiring them to wait in Mexico for an asylum interview significantly curtailed frivolous applications. Once the protocols were repealed, frivolous asylum claims shot up once again.

The Biden administration also contributed to the problem by ending agreements with several Central American countries that curtailed illegal migration. The president's stated desire from the beginning of his administration was to end Title 42 expulsions, a pandemic-era policy that allowed the Border Patrol to send non-Mexicans back across the border. This move also encouraged more people to come. Unlike in prior decades, the vast majority of those now stopped at the border are not from Mexico and normally cannot be returned to that country.

The administration could have subjected non-Mexicans caught at the border to what is called "expedited removal" and sent them back home relatively quickly. In addition, virtually all of them could have been held in detention before the numbers became unwieldy. But DHS decided not to take either route. Once word got out that the new administration was not going to detain people, send them home quickly, or require them to wait in Mexico, the number of people coming to the border skyrocketed. The entire system was quickly overwhelmed. This encouraged ever more people to come in hopes that they, too, would be granted parole or released and given a court date many years in the future.

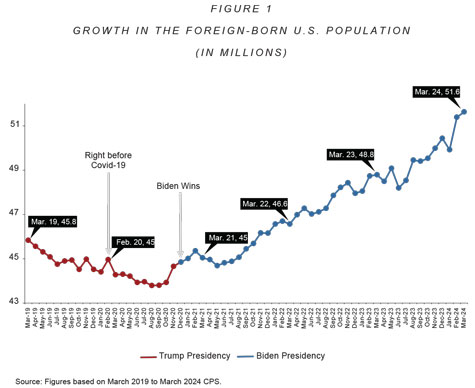

How has all of this affected the population of illegal immigrants in the United States? Although not specifically designed to measure migration, the monthly Current Population Survey (CPS) shows that the total foreign-born population grew from 45 million in January 2021 to 51.6 million in March 2024 — an astonishing 6.6 million-person increase. This is the net increase, not the number of new arrivals, which of course is offset by out-migration and deaths. The total immigrant population has never grown by this much this fast.

The 51.6 million immigrants, legal and illegal together, now living in the United States have set a new record. Immigrants now make up 15.6% of the U.S. population — almost double their share in 1990 and more than triple what it was in 1970. This surpasses the old records of 14.8% in 1890 and 14.7% in 1910. As far as immigration is concerned, America has entered uncharted territory.

By March of this year there were probably 13.7 million illegal immigrants in the United States, a net increase of 3.7 million immigrants since January 2021. Unfortunately, we cannot estimate the number of illegal immigrants more accurately in 2024 because all the administrative data necessary to do so is not yet available.

Additionally, as big as the numbers are, the size of the foreign-born population in the March data still seems too small given the number of border releases, got-aways, and visa overstays. The way the Census Bureau collects and weights data simply cannot fully capture a sudden influx of illegal immigrants. That said, the idea that there are 20 or 30 million illegal immigrants in the country, as some commentators and politicians on the right now maintain, is simply not possible for all the reasons discussed earlier. It is possible that the total illegal population reached 15 million, or maybe even 16 million, by 2024.

The administration has provided the public with virtually no information on those released into the country. One of the few things we do know is the country of birth for most border encounters, and although we can say that the recent influx is predominantly from Latin America, immigrants from India, China, Africa, and the Middle East are showing up at the border in ever larger numbers.

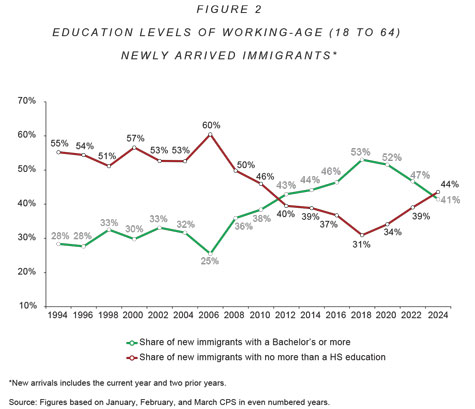

We can also say that the enormous strain on social services they are creating in cities across the country suggests that many are arriving with few resources and skills. The monthly CPS shows a dramatic decline in the education level of newly arrived adult immigrants overall (see Figure 2 below). In the first part of 2024, 41% percent of all immigrants ages 18 to 64 who came to the United States during the prior two years reported they had at least a college education. As recently as 2018, it was 53% percent for all new arrivals. This decline in the education level of new immigrants overall almost certainly reflects the growing share of newcomers who are illegal immigrants.

FACING REALITY

By design, and understandably, our progressive system of spending and taxation means that low-wage workers collectively serve as a net drain on our nation's treasury. Cities and towns across America have worried for decades about losing their middle-class tax base. If a city cannot fund its government with a lower-income population, how can a country?

The negative impact on public coffers of less-educated people, regardless of their immigration status, is not a character flaw: It is simply a reality in any modern post-industrial society with a large welfare state. Our permissive immigration policies certainly make it easier for criminals and terrorists to enter, but the vast majority of illegal immigrants are neither. Indeed, unskilled immigrants today are not all that different from those who came during the last great wave of immigration from 1880 to 1920.

But America was a fundamentally different country then. The government represented just 3% of GDP in 1900, compared to 36% today. There was no welfare state. The arrival of low-income people, therefore, did not have the profound negative fiscal impact it has today.

We should have an immigration policy that reflects current economic and fiscal realities, and enforce it. If we don't, we must accept the unavoidable drain on the public fisc that will result.