The Truth about College Costs

A search for "college tuition" in the New York Times returns about 24,000 articles. One noteworthy piece in the archives is a 1927 letter to the editor noting that for annual tuition, "of fifteen Eastern colleges, all but four are now charging $400." According to the author, a Mr. William Allen, nationwide data showed that another 28 colleges charged over $250, while 288 charged under $200. But Mr. Allen did not write to complain that college tuition was too high; on the contrary, he wrote to encourage every college to charge the highest price, $400, to secure better pay for their faculty and staff.

Needless to say, America's colleges did not follow his advice. To take one example, Luther College in Iowa cost $125 in 1927 — less than a third of Yale's prevailing fee. It would take until 1951 for Luther to cost $400, by which time the Ivies were charging $800.

This persistent difference in cost between providers of a similar product is a common market structure: The price of a few leaders is two to three times more than the typical offering, some others trail close behind, and the vast majority of providers make up the broad middle. In 1927, Harvard cost $300 (raised to $400 in 1928), Amherst cost a little less, and the typical private college was under $200. Mr. Allen knew that the typical college struggled to make ends meet, so he asked a simple question: Why shouldn't everyone charge $400?

The answer was, and remains, the boring, predictable reality of markets. Colleges then and now can only charge what the market will bear, and the market for college tuition looks a lot like the one for cars, lawyers, office space, or cheese. Only so many people are willing to pay for Gruyère; for most, Wisconsin cheddar will do.

Tuition is much higher now than it was in 1927, as everyone knows, but the basic market structure described above remains the same. At the top, about 100 elite institutions can charge a premium for a four-year degree. As the Varsity Blues scandal and related revelations made clear, the notional market-clearing price for an elite degree is far more than even those elite institutions' own sticker prices. Yet elite colleges and universities educate a small and highly unrepresentative fraction of American college students: The top 100 private schools enroll around 500,000 students, while the remaining 2,600 four-year schools enroll about 10.5 million students. For the latter group of schools, market tuition, excluding room and board, is about $15,000 a year. If we add $10,000 for room and board (more in cities, a little less in small towns), we can see that 96% of American college students pay $25,000 annually for tuition and housing. Right now, with some variation here and there, that is what a four-year college degree costs.

This simple fact is nearly invisible, however, because college prices are distorted by a system that deliberately lists tuition levels much higher than what students pay. The practice has caused needless anxiety for millions of families, forced college leaders onto an annual high-sticker-price/high-discount merry-go-round, and distorted our national conversation about student debt. To end the charade, officials don't have to pass any new laws; they simply need to enforce long-standing consumer-protection rules.

HOW WE GOT HERE

In the late 1980s and early 1990s, colleges discovered that the appearance of high tuition was good for marketing. Positioning one's school as "almost as expensive as Harvard" created a sense of exclusivity and, somewhat contrary to economic theory, resulted in increased applications. It also led to free media coverage, as newspapers found stories about the high cost of college were evergreen.

Of course, almost nobody was willing to pay Harvard-level tuition for a middling college education. Colleges resolved this problem by canceling out their high sticker prices with "institutional scholarships" that had no money behind them; they were simply the discounts a school had to offer to convince students to enroll. The game was easy: It required no fundraising to endow scholarships, just the appearance of a high price paired with the appearance of a scholarship. This "high-sticker, high-discount" practice worked magic for enrolling students — and it was free. It soon spread to institutions nationwide.

In its early years, high-sticker, high-discount pricing was regarded as a harmless white lie. Schools advertised slightly overstated tuition, which they offset using phantom scholarships that were really just discounts. But things got out of hand quickly.

Throughout the 1980s, colleges kept publishing ever-higher tuition numbers. Meanwhile, the tuition students actually paid rose only slightly. A 1992 New York Times article offers a snapshot of college pricing in the early years of the high-sticker-price/high-discount era:

College tuition bills have been skyrocketing for the past decade. According to the National Center for Education Statistics, the average tuition fee for a private four-year college has exploded to $11,379 last year from $3,811 in 1980; a prestige school like Harvard will charge a whopping $15,870 in tuition for 1992-93....Based on current projections, this year's tuition of $14,403 for a private school will spiral to about $34,000 by the year 2005.

Controlling for inflation, college tuition had risen about 600% from 1927 (when Mr. Allen's letter appeared in the Times) to 1992. And, as the article above predicted, published tuition would spiral upward in the decade after 1992. But as few people realized then or now, the apparent rise in tuition after the mid-1990s would be almost entirely illusory.

By 1999, the fundamental dishonesty of college pricing had become clear to anyone willing to take a closer look. That year, American private colleges purported to award scholarships worth more than all the tuition they collected — which is to say, their average discount had exceeded 50%. It would take an endowment worth about 15 times a school's annual budget to fund scholarships at that level. Only a handful of schools have such bulge-bracket endowments; a typical healthy college's endowment is three or four times its annual budget, and many colleges would be happy to have an endowment equal to a year's operating costs. These scholarships, therefore, could not have been real.

EMBRACING THE LIE

Colleges offer phantom scholarships for the same reason car dealerships offer discounts: to close the sale. But even as this practice has become too obvious not to notice, families still orient to college prices as though they are real. Why is this?

Professional marketers have long known that people are attracted to expensive things — and we have a special fascination with things we cannot afford. Teenage boys hang posters of Lamborghinis, not Toyotas, in their bedrooms. Unattainable products also generate free media: Journalists and bloggers write about the new Rolex, not the new Timex.

At the same time, we are highly responsive to the belief that we are getting a deal. In consumer markets, this practice of creating the appearance of a high price paired with a large discount drives purchase behavior so reliably that it works even when everyone knows what's going on. Retailers, to take one example, routinely pre-print price tags with a struck-through "original" price that buyers never pay and a "marked down" price that was always the real price. Everyone knows what's happening, but the practice continues because we respond to it anyway.

Of course, in the college context, this reality is invisible to most families. Mainstream newspapers never report on it, in part because it's difficult to see and in part because it doesn't generate sensationalist headlines. The sincerity with which tuition and housing costs are quoted and repeated by the colleges themselves is also a contributing factor. But that sincerity is heavily buttressed by the government-run system that discloses college fees and manages federal financial aid.

Colleges are required to disclose their official cost of attendance to the U.S. Department of Education; however, these figures are never validated. Colleges can effectively fill in any numbers they want — and they routinely do so. On the other side of this regulated transaction, families fill out the dreaded FAFSA, on which they are not expected to write down any numbers they want, and the numbers they write will be validated. Colleges use the resulting FAFSA data to calculate information like the expected family contribution. For families, the whole system feels as serious as a conversation with the IRS.

But unlike when (most) people deal with the IRS, many of the numbers colleges report are fake. Today, most private colleges discount their published tuition by 60% or more for virtually every student. Colleges, just like car dealerships, are subject to market forces. Tesla would surely love to price its cars according to family income, but that's not how markets work.

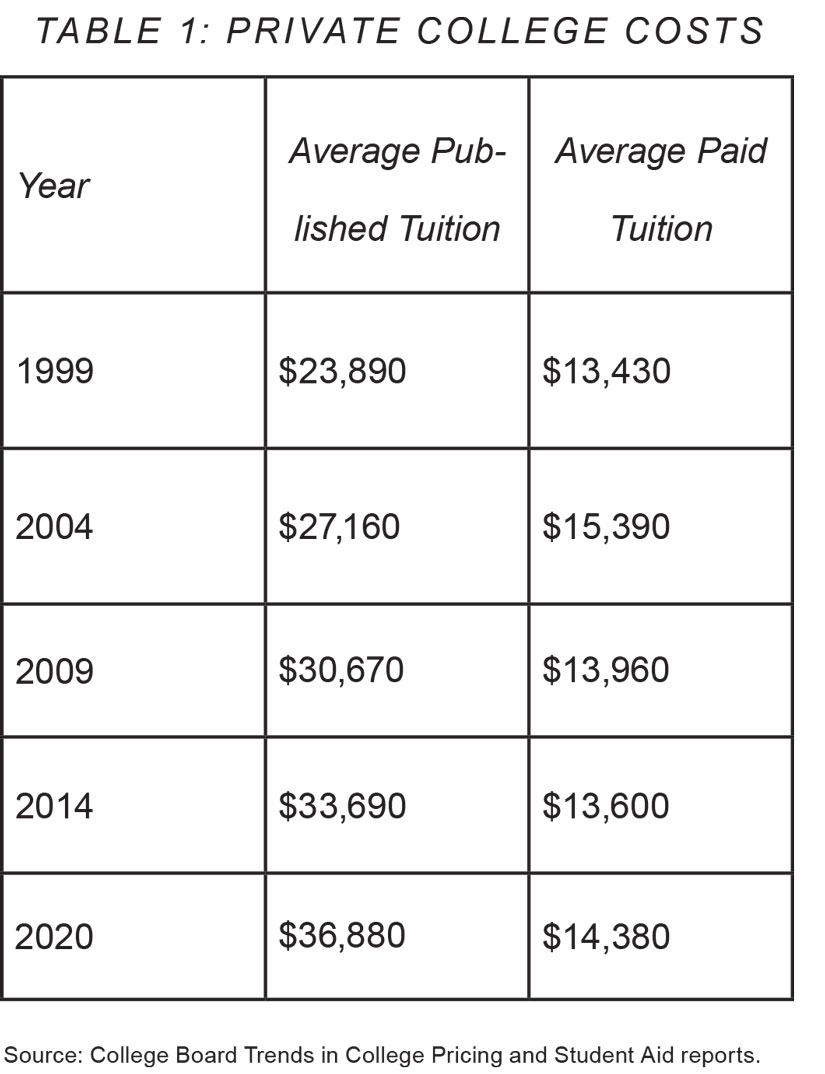

In real-dollar terms, today's private-college students pay a little less than they did in 2005; that year's paid tuition was only about 10% more than it had been 10 years earlier. A data series from the College Board in constant 2020 dollars makes this plain: It shows published tuition in the first column — that is, what colleges purported to charge in the years from 1999 to 2020. In that respect, tuition rose persistently, suggesting that students paid $13,000 more in 2020 than in 1999. But the right-hand column shows what students actually paid. That figure peaked in 2004 and then fell soon afterward.

The fact that students are paying less for college than they did 15 years ago is deeply contrary to conventional wisdom. Yet college financial statements, Common Data Set disclosures, IRS Form 990s, and the annual tuition studies of higher-education industry groups verify it.

Of course, even mentioning to the parents of a school-aged child that college hasn't gotten appreciably more expensive since the late 1990s won't just provoke disagreement; it could start a fight. College is ruinously expensive. Everyone knows it. We know it even though we send our kids to college and are not ruined. We know it even though there are obviously not enough truly rich families to pay $50,000 per year for the 11 million students who attend our 2,600 four-year higher-education institutions. We know it even though professors are poorly paid, colleges are financially strapped, and every year a few more schools close their doors. We know that colleges cost over $50,000 a year — but they are somehow also running out of money.

How can this be?

Simply put, higher education is an overwhelmingly fixed-cost business, and few colleges fill their incoming classes. As a result, market-clearing tuition for the marginal qualified student the day classes commence is, at least in theory, $1. This means that the average price students pay, regardless of whether they are rich or poor, is unlikely to climb any time soon.

Of course, elite schools like Harvard are different. Affluent families often pay the full published tuition at these schools. Elite schools simply have more market power, so the market can bear their higher costs. But nearly every college still claims to charge a comprehensive fee almost as high as Harvard's, and this practice has made the specter of paying for college one of our culture's most terrifying beasts. The beast, however, is a sheep in wolf's clothing.

I have focused on private-college pricing here because the data, while still rather convoluted, are far easier to analyze than those of a public university. But as noted above, markets don't distinguish between public and private schools, and public universities play all the same pricing and scholarship games for all the same reasons. State law generally controls in-state student tuition, but when dealing with out-of-state students, public universities play the high-sticker-price/high-discount game all the same.

For schools of every kind, the deception grows more implausible every year — and its language is thinning, too. Colleges now regularly use the term "discount" when whispering offstage, then switch back to "scholarships" or, more piously, "institutional aid," when performing for families and students. College leaders have come to hate this deception, but as long as high-school seniors respond to it, the show must go on. In this sense, our national delusions about the cost of college are everyone's fault.

CREATIVE ACCOUNTING

Faculty and staff at most colleges find the national conversation about skyrocketing tuition disorienting, since they know their employers are struggling to make ends meet. Here again, fake tuition numbers have escaped the finance office and infected our understanding of how the system works.

Beloit College, a high-quality liberal-arts college in Wisconsin, supplies a typical example. Beloit's sticker price is $69,000 including room and board and other expenses, so with around 1,000 students, the college's annual program revenue would be $69 million if the sticker price were real. Of course, it's not; students pay around half that amount. The college's endowment provides a few million dollars in annual support, giving Beloit a total 2019 operating budget of $43 million.

The gap between notional and real revenues wipes away the claim made by many schools that, while tuition is high, it nevertheless does not cover the full cost of operations — which is why colleges must turn to other sources of support. This is true of the tuition students actually pay, but it's no defense of the $60,000 to $80,000 schools now commonly purport to charge. In fact, if a typical college collected its sticker price in full, its leaders would hardly know what to do with all the money. Beloit would have an extra $26 million per year against a budget of $43 million.

The gap between notional and real revenues has made a mess of college tax filings, too. To use the Beloit example, the college reports its revenues as though every student pays full tuition. In 2019, Beloit reported about $75 million in total revenue on its IRS Form 990, even though $35 million of that money was never asked for and never paid. To fill the gap between fantasy and reality, Beloit's Form 990 reports "Grants and similar amounts paid: [$]35,469,256." To be clear, Beloit never had $75 million in revenue; that number is an accounting fiction derived from the school's published tuition, which is based on nothing whatsoever. Beloit also did not "pay" $35 million in grants and similar amounts: It simply marked down a price that was never real, since vanishingly few families would pay $280,000 for any but the most elite four-year degree.

Every college's Form 990 looks this way: an impossible number under "Total Revenue" brought back to reality by an impossible number under "Grants Paid." That the entire sector operates this way has quelled the concerns of at least a few college trustees, whose responsibilities include approving the school's tax filings. Another source of comfort is the fact that these fantastical figures are uncritically accepted by the Department of Education and, apparently, the IRS. So while a close examination of college finances will reveal a series of preposterous claims, participants in the system have learned to believe many impossible things.

HARMING THE POOR

Our collective dishonesty on matters of pricing causes harm in a host of ways. For one, the impression that college is ruinously expensive has induced unnecessary anxiety in millions of families and scared many students away from college entirely. It has also led to a confusing national conversation about student debt, since nobody can figure out what college really costs or whether students are paying too much. High published tuitions at non-profit colleges have also laid the groundwork for for-profit schools to charge wildly inflated prices, since their students' expectations of cost were anchored by the well-publicized sticker prices of private four-year schools.

A system rife with misleading information might be tolerable if every family ended up paying the same amount to attend the same school, or if cross-subsidies between students at least ran in a coherent direction. But one of the most concerning dysfunctions of the current system is that lower-income students often pay more tuition than the average student.

From the outside it seems that schools are playing Robin Hood: They charge wealthier families the full cost of tuition, then use the excess funds to offer scholarships and other financial aid to poorer ones. Many people still believe this. But markets don't care if students are rich or poor, so for most schools it's a wash: Higher published tuition is wiped out by the discounts necessary to get enough students to enroll, and schools have no reason to offer more generous discounts to poor students than rich ones. To the contrary, since colleges care about student quality, they give larger "scholarships" to better students, and those students disproportionately come from more affluent families. As a result, rich families often receive more aid on average than poor ones.

The impression that college naturally costs $50,000 or more per year has induced some parents to take out crushing debt loads to finance a child's college dreams. This is possible because certain Federal Student Aid loan facilities allow it — the PLUS program in particular. But the real root cause is that many families simply believe there is a $200,000 tollbooth on the road to the American dream, so they sign the loan forms.

Once dishonest marketing practices had become fully mainstream, they opened the door for even bolder falsehoods to walk through. Financial-aid letters now often mislead students into believing loans are "aid," or that the total cost of attendance is much lower than it is. Waitlists are often illusory: They're manipulated to force students to commit to attend a school without considering other options, or to sustain a college's relationship with an affluent family. Early-decision practices are used to squeeze more tuition dollars out of families by short-circuiting the market's natural course. And, of course, colleges have to manipulate their accounts to represent these practices in financial reports and tax filings.

THE MERRY-GO-ROUND

Nobody in higher education wants to participate in the system of fake prices and fake scholarships anymore, but nobody can figure out how to escape from it. A tale of two colleges — Able and Baker — will show why honest pricing is nearly impossible to sustain in this environment.

Let's say Able College decides to stop publishing a false cost of attendance of $55,000, opting instead to advertise an honest price of $25,000, which is what most of its students actually pay. Nearby Baker College, meanwhile, keeps its sticker price at $55,000, though nobody pays more than $25,000 there, either.

Able's board may think it has done the right thing, and maybe it has. But board members are courting enrollment disaster. When Johnny is admitted to Able, he receives no scholarship; Able has already eliminated the fake $30,000 in tuition it was never able to charge, so it simply asks Johnny to pay $25,000 to attend the school. But when Johnny is admitted to Baker, he receives not only a letter of admission, but a $30,000-per-year "merit scholarship" on cream-colored cardstock with effusive language about his intellect and character (though nothing about his athletic abilities, since that would violate NCAA rules). Baker tells Johnny that his exceptional skill has earned him "$120,000 over four years." Johnny's parents and grandparents proudly tell their friends about "how much money Baker gave to Johnny," and Johnny chooses to attend Baker over Able.

To be clear, the offer is identical in both cases; it's just that Baker's actual annual cost of $25,000 is dressed up in an illusory $30,000 premium and an offsetting $30,000 scholarship. In most cases, Johnny is an unremarkable student, and the same "merit scholarship" letters go out to most of Baker College's admitted students. Johnny and his family might see that the "offer" from Able is the same as Baker's, but they invariably feel that Baker is the more prestigious option because of its (fake) high price, and that Baker "wants Johnny more" because of its generous scholarship offer. Able has unilaterally disarmed itself in the phantom-scholarship wars.

The cultural forces involved are so powerful that even the best institutions with the best of intentions must bend.

Olin College of Engineering has been exemplary in its attempt to abjure many of the unhealthy conventions of American higher education: The school is small, focused on teaching, provides athletic and extracurricular opportunities in sensible and affordable ways, and began with the vision of allowing highly qualified students to study tuition-free. When that dream (and Olin's endowment) ran aground during the Great Recession, the school started charging tuition.

In describing the resulting system, Olin explains that the cost of attendance for the 2023-2024 academic year is $86,474, but every admitted student, regardless of need, receives a scholarship of $29,986. Why not just say the cost of attendance is $56,488? Because "scholarship" is a magic word in American culture. Olin is highly selective (only 16% of applicants are admitted), but even elite schools have to compete to enroll their entering classes. Since virtually every other school offers its admitted students phantom scholarships, Olin would put itself at a disadvantage by advertising its tuition price alone.

Where does Olin's $86,474 cost of attendance come from? It's not the per-student cost to run the college — that's about $109,000 based on Olin's financial statements. And it is clearly not the real-world cost of attendance, which is $56,488. So why does Olin claim an official cost of attendance of $86,474? Because that's what top schools claim in their financial statements for their cost of attendance, and it's what families are used to seeing. It's a facsimile of a market price — and in the contemporary college market, facsimiles are all we have left.

RESTORING ORDER

For the reasons described above, schools won't, and arguably can't, stop their deceptive marketing practices. And for reasons having to do with antitrust law, the Department of Justice won't let them consult with one another and agree to change how much they charge for their services. Yet because dishonest scholarships are at the heart of the pricing ruse, there may be ways to change the system by applying some well-established consumer-protection laws.

First, states could simply enforce their consumer-protection statutes, all of which forbid misleading statements and deceptive practices. Any state's attorney general could bring an action against colleges making misleading claims about scholarships. However, this approach would disadvantage in-state colleges even if the rule applied equally to any college nationally. The practicalities of this approach, therefore, make it an unlikely solution.

Perhaps more promising is the fact that federal regulations also forbid misrepresentations and misleading statements. The passage below from the Department of Education's regulations could have prevented the whole high-sticker-price/high-discount era if it had been enforced all along:

Substantial misrepresentations are prohibited in all forms, including those made in any advertising, promotional materials, or in the marketing or sale of courses or programs of instruction offered by the institution.

As now used by colleges, the terms "scholarship," "institutional aid," "merit aid," and the like are substantial misrepresentations. There is no money behind these "scholarships," and it is not "aid" for a seller to discount an inflated price that nobody pays.

Most colleges' claimed cost of attendance is a substantial misrepresentation, too. And it is particularly surprising that these reported costs have been so badly manipulated, since the term is defined by statute. The Higher Education Act defines "cost of attendance" as "tuition and fees normally assessed a student...in [a particular] course of study." The department could give the words "normally assessed" their natural meaning. Is $69,000 "normally assessed" when the average student pays $25,000? Is it "normally assessed" when every admitted student is guaranteed a scholarship worth half the amount? What does "assessed" mean in that context? Is $69,000 an accurate statement of tuition and fees for a non-profit college whose per-student cost to operate is $40,000, or $110,000? Colleges should be required to report costs of attendance based on the money that changes hands in every case, whether paid by real scholarship dollars or by the students themselves.

Making tuition simple and clear would not make college cheaper, but it would likely return us to the kind of pricing practices Mr. Allen described in 1927, when it was easy to see that Bowdoin was cheaper than Harvard. Bowdoin is still cheaper than Harvard, but you'd never know it now: Bowdoin's published tuition today is $4,000 higher than Harvard's. With falsehoods like that gone, we could restart the national conversation about college costs and student debt without having to believe a series of impossible things.