The Perils of Hospital Consolidation

Since the passage of the Affordable Care Act in 2010, most of America's health-care policy discussion has focused on insurance expansion as a way to "bend the curve" of the country's outsized health-care spending. The Obama administration has touted the ACA as a reform that not only extends coverage to millions of Americans, but also reduces the long-term cost of care. Yet if one looks under the hood of our health-care system, the big cost driver isn't a lack of access to preventive care. Rather, hospital care, which comprises about a third of national health-care spending, is the single biggest line item in the nation's health-care bill.

Understanding the hospital sector, and particularly the transformative effects of consolidation on that sector, is critical to diagnosing America's health-care cost disease. Over the last few decades, state and federal policies and regulations have encouraged this consolidation of hospitals, a trend that has only been exacerbated by the ACA. As a result, hospitals have assumed more market power, producing worse outcomes and higher prices for patients.

In order to actually reduce costs and put patients first, policymakers should prioritize reforms at the state level, where health-care markets operate. Through policies that reduce barriers to entry for innovative firms, pay providers based on outcomes, and increase the transparency of costs for both patients and insurers, states can begin to introduce more competition into health-care markets and better serve patients. Such reforms would also push back against the legacy of regulations that have enhanced the market power of hospitals in recent years at the expense of patients.

THE ROOTS OF CONSOLIDATION

Before embarking on a history of consolidation in the industry, understanding hospital spending patterns is crucial. After all, if we assume that heavily consolidated hospital markets are more expensive (and they are), and that the more expensive they are the more we spend on hospitals (and we do), trends in hospital spending are an indispensable tool for gaining insight into the competitive dynamics of the industry.

In the late 1980s and early '90s, hospital spending grew at a staggering rate of 8% to 10% annually. The exact reasons for this spending growth aren't entirely clear (though Medicare reimbursement policies were certainly a driver), but the prevalence of conventional insurance policies — which tended not to impose serious utilization restrictions on members (like co-pays, co-insurance, networks, and pre-authorization, for instance) — likely contributed.

This is a somewhat convincing explanation, not only because it rests on solid theoretical ground, but also because the expansion of managed care in the industry throughout the early to mid-'90s coincided with a significant slowdown in spending growth. Before the late '80s and early '90s, "traditional" insurance was generous and mostly open-ended. Typically, a patient would go to a doctor or hospital, pay a co-pay, and the insurer would pay the bill with little thought. But as health-care spending grew unabated, insurers (both public and private) needed a way to slow the growth of such spending. The managed-care boom was their response.

Unlike the traditional insurance of years past, Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) relied on a variety of approaches, including network and utilization management, to reduce unnecessary consumption of health-care resources. When patients chose to see a doctor out of their network, they were on the hook either for the entire cost or for some significant share of it. In other words, patients paid more to have a choice. This created, for the first time, significant demand-side constraints on the ability of hospitals to exercise their market power and raise prices and spending.

Critics contended that HMOs, the most relevant form of managed care, constrained patients' choices in doctors and hospitals through a distant bureaucracy — in this case, an insurance company. HMOs typically restricted patients by allowing them to see only a very narrow set of providers, who were often employed by the HMO itself (an approach commonly known as a "staff model" HMO). By all accounts, these insurance arrangements were successful — too successful, in fact. In the mid-'90s, inpatient hospital-spending growth plummeted, falling into negative territory on the order of about 6%. And broadly, national health-care spending held relatively constant, hovering around 13% of GDP for much of the '90s.

There were two sets of responses to the growth of managed care in the early '90s. First, hospital mergers took off. According to data from Booz & Co., a global consultancy, hospital mergers peaked in 1997, after growing steadily through the early '90s. As a result of this trend, hospital markets in metropolitan statistical areas with fewer than 3 million people became 27% more consolidated from 1987 to 1997. This would position hospitals well for later years, when they would be able to use this newfound consolidated power to once again raise prices and spending.

The second was a political response, resulting in well-intentioned but poorly designed policies. As an answer to the perceived greed and seemingly arbitrary restrictions imposed by managed-care plans, states implemented a variety of regulations ranging from access rights to so-called "any willing provider" laws. The goal — typically framed as creating a "patient's bill of rights" — was to limit the ability of managed-care plans to dictate which providers patients were eligible to see and which services they could be provided. The severity of these laws varied. Some simply stipulated that a minimum number of specialists must be included in the HMO's network, while others went further: Any-willing-provider laws effectively told insurers that as long as a provider was willing to take their payment, it must be included in the network.

Of course, ensuring that patients weren't being denied necessary care was vital. But New York's regulation of insurance markets in the '90s — culminating in the oft-discussed "death spiral," in which prices skyrocketed as too few healthy individuals bought or could afford expensive plans to pay for the claims of sicker patients — illustrates the potential for unintended consequences of regulation. Indeed, one convincing analysis by Maxim Pinkovskiy, an economist at the Federal Reserve Bank of New York, estimates that, nationally, managed-care regulations raised the health-care sector's share of GDP in 2005 by two percentage points. Similarly, laws aimed at restricting HMOs helped lead to the failure of Kaiser Permanente — a poster child for successful care integration — in North Carolina.

WHY CONSOLIDATION?

This brief history of consolidation helps to explain the rise in hospital mergers. For starters, consolidation could theoretically lead to economies of scale. In industries with high upfront costs and relatively low marginal (or variable) costs — a radiology tech's salary is a fraction of the cost of an MRI machine — the optimal arrangement may not be a completely competitive market. To fund the necessary capital investments, a certain minimum level of revenue is needed, which is more easily reached with a few large players rather than several small ones.

The health-care buzzword for achieving economies of scale is "care coordination." This loaded term doesn't only include the kind of brick-and-mortar spending we might imagine. In reality, it encompasses everything from reducing duplicative testing (e.g., by investing in electronic health records) to ensuring that patients discharged after a heart attack adhere to prescribed drug and dietary regimens. But the argument remains a straightforward case for economies of scale: It's easier to finance a well-functioning, inter-operable electronic health-record network as part of a large health-care system than it is with several small hospitals, and tracking patient habits after discharge is easier (and more financially beneficial) when a hospital also owns some physician practices or outpatient clinics. Typically, this is what economists mean when they speak of "economies of scale" — by which average costs decline with volume.

Economists also speak of a similar phenomenon called "economies of scope." The best way to understand this is to consider why McDonald's produces both burgers and fries. Because people tend to want fries with their burger, there's an inherent cost advantage to doing both under one roof rather than having one chain produce only burgers and another only fries. Although the health-care world is far more complicated, the same logic can often still apply. Laparoscopic equipment (essentially a thin tube with a camera) purchased for use in gynecology can also be used to help treat diseases like appendicitis or investigate how much a cancerous tumor has grown. Here again, the cost advantage of diversifying across different specialties is clear.

A cynic may (correctly) point out that the theories of economies of scale and scope aren't the only relevant factors when it comes to hospitals; economic theory also predicts that the more consolidated a market is, the higher the prices charged by producers. In a purely monopolistic market — where there is one seller and many buyers — the seller delivers a lower quantity at a higher price than what would be sustainable in a competitive market. This implies that a hospital's motives for consolidation may not exactly line up with what's best for society.

Beyond economic theory, existing trends in the health-care industry also offer some insight. One trend in particular that's shown little sign of abating is a growing shift from inpatient to outpatient care. The reason for this shift isn't entirely clear, but it likely has to do with technological developments that allow diseases that previously required hospitalization to be treated in a physician's office or a hospital outpatient clinic. This is a great development for health-care consumers — fewer hospitalizations means reduced possibility for hospital error, and, in general, better outcomes for patients.

But for hospitals, this shift means that an important revenue stream gets squeezed. Figuring out how to replace those revenues thus becomes a priority. That means "scaling out." Buying up physician practices and outpatient clinics (such as oncology centers for cancer patients) helps hospitals capture some of the revenue that would otherwise be generated elsewhere. While estimates vary, it's likely that at least a quarter of all physicians are now employed by hospitals; recent estimates from the Wall Street Journal and Credit Suisse put that number at closer to two-thirds. And for some specialties, there are now few if any options remaining outside of hospitals.

Take oncology, for instance. In October 2014, the Community Oncology Alliance reported that, of nearly 1,500 oncology practices, roughly one-third had been acquired by hospitals, with some states experiencing even more consolidation. In Kentucky, for example, 18 out of the 20 remaining oncology practices are hospital-owned. Meanwhile, Delaware has seen its four clinics close up shop entirely.

The underlying causes of hospitals' buying frenzy can be debated. Reporting on the phenomenon, the New York Times hinted at a possible insurance problem. Insurers, it turns out, pay much higher rates for chemotherapy drugs dispensed in hospitals or affiliated clinics — which makes hospitals a kind of refuge for community oncologists. Insurers could change their fee schedules to equalize payments between hospitals and clinics, but the current payment system is also likely influenced by hospital market power.

In sum, there are strong incentives for hospitals to charge as much as possible for the inpatient care they continue to provide, and to do what they can to capture the outpatient revenue stream as well. And there are few better ways of doing so than increasing bargaining power against insurers through consolidation.

The ACA's experiment with Medicare Accountable Care Organizations (ACOs), and penalties for re-admissions and hospital-acquired conditions, likely play an important role here, at least as harbingers of what's to come. While the actual effect of these consolidation efforts hasn't been thoroughly studied, the number of hospital merger and acquisition deals has been growing steadily since 2010, the year the ACA was signed into law.

Other incentives are also at play, not entirely independent of the ACA. Insurers — both public (Medicare, some state Medicaid programs, and a handful of public-employee health plans) and private — have begun to demand something tangible for the money they hand over to hospitals and other providers. They've learned from the lessons of the '90s, and rarely take a "just say no" approach to limiting provider networks. Increasingly, payments are tied to some measure of outcomes, limiting hospitals' ability to simply charge what they want.

Medicare's experiments with ACOs, for instance, though only marginally successful, offer shared savings for health systems that meet certain benchmarks. California's CalPERS, the public-employee retiree health-care program, has experimented with reference pricing for hip and knee replacements. (This approach pays hospitals a fixed amount for the procedure, while shifting any charges above that to patients.) And private insurers around the country are experimenting with bundled payments (a fixed sum of money to treat an illness) and capitation (a fixed sum to care for all the needs of a particular patient population).

This shift to paying for some measure of value in health care looms large for hospital executives, and is perhaps one of the major factors driving recent M&A activity. For hospitals, fiscal solvency in the future will mean participating in more value-based contracts and taking on increased risk. And this requires, first and foremost, care coordination, which is most easily achieved through clinical or financial integration. Of course, this brings us back to the search for economies of scale that we hope can deliver better outcomes at lower costs.

Kaiser Permanente is often held up as a model of a successful integrated care-delivery system. The possibilities, we're told, if insurers and regulators would just get out of the way, are endless. At least this is the typical justification offered by industry trade groups and hospital administrators. One recent study financed by the Federation of American Hospitals (an industry trade group) supports the notion that patients benefit from consolidation:

[H]ospital realignment offers benefits including improved service offerings, cost reduction, and enhanced competitiveness....[And] without realignment, patients and communities could face disruption and instability, hospital closures, and reduced access to care.

Hospitals have further claimed that, since they are non-profit firms, they will not behave in an anti-competitive way. In addition, health-care markets differ from traditional markets in several ways: product differentiation, imperfect information, extensive government regulation, and the non-profit status of many firms.

But the reality — according to years of independent academic inquiry — is that these benefits are much more meager than advocates would have us believe, and the harms are much more severe.

LOWER QUALITY, HIGHER COSTS

Famed economist Kenneth Arrow was one of the first to apply a rigorous framework in assessing the competitiveness of the U.S. health-care industry. He warned that the "price-quantity implications of the competitive model for pricing are not easy to derive without major — and, in many cases, impossible — econometric efforts." Health-care markets are further characterized by multiple imperfections, in large part deriving from the uncertainty and asymmetry of information between buyers and sellers that are inherent in the nature of health and medical care.

Since Arrow's landmark paper in 1963 on the economics of medical care, there has been much progress in the development of advanced econometric methods and the availability of health-care data to assess the effects of more concentrated markets. Though industry trade groups would never acknowledge this, the effect of horizontal hospital consolidation (where hospitals merge with or buy up other hospitals) is one of the few areas where economists have reached a broad consensus.

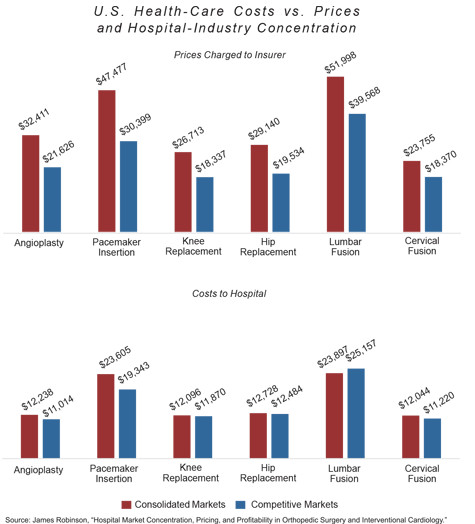

The overwhelming evidence stands sharply at odds with economic theory. Whatever theoretical (or actual) benefits accrue as a result of hospital consolidation, they are mostly undetectable. Horizontal consolidation among hospitals almost universally results in higher prices and worse (or unchanged) patient outcomes, despite the fact that costs to hospitals do not significantly increase as a result of the consolidation (see the chart below). The evidence on so-called vertical consolidation — when hospitals or health systems buy up physician practices or operate an insurer — is somewhat more mixed.

One approach that can help minimize bias and cherry-picking in economic studies is to take advantage of so-called systemic reviews or meta-analyses. In these kinds of studies, researchers evaluate a body of literature rather than only one or two analyses, to make more generalizable claims. The Robert Wood Johnson Foundation has sponsored two such reviews of the literature on hospital consolidation — one in 2006 and more recently in 2012.

The overall results from 2006 — that horizontal consolidation leads to worse outcomes and higher prices — were mostly unchanged in 2012. The 2012 review concluded that, across a variety of geographic markets and different data sources, hospital consolidation results in higher prices. In particular, when hospitals merge in already heavily consolidated areas, price increases can surpass 20%.

One recent study by Berkeley health economist James Robinson (which was not included in the 2012 review) doubles down on these findings. Based on data from 61 different hospitals, and using a metric of hospital consolidation known as the "Herfindahl-Hirschman Index" (the higher the HHI, the more concentrated the market), it finds that hospitals in concentrated markets with above-median HHI charge 44% higher prices than hospitals in more competitive markets with below-median HHI, even though the two hospital groups have only a 6% difference in underlying costs. In plain English, this means higher profits for hospitals with more market power.

Post-hoc analyses of unsuccessfully challenged mergers have generally come to similar conclusions. The Sutter-Summit merger in California was challenged by the state's attorney general, but the courts allowed it to proceed. A 2008 Federal Trade Commission working paper evaluating the price effects of the merger found that, due to the increase in market concentration resulting from the merger, price increases were 23% to 50% greater than those in a control group.

But it's not just about costs. Researchers from the Dartmouth Institute for Health Policy and Clinical Practice found that, among Medicare patients, "greater competition leads to higher quality in heart attack patients," though with mixed results for dementia patients. Nevertheless, the reviews from 2006 and 2012 both conclude that, generally, even in administrative-pricing systems like Britain's National Health Service or Medicare in the United States, competition results in better quality for patients. The most concentrated Medicare markets, for instance, have mortality rates about one and a half percentage points higher than the rest.

The mixed results may be due to the fact that, where there are market-determined prices, hospitals can compete on both quality and price, but may choose to compete more intensively on one. It's safe to conclude, however, that consolidation is still typically associated with lower quality.

VOLUME AND OUTCOMES

As for vertical consolidation — hospitals acquiring physician groups or outpatient centers, for instance — the evidence is more mixed. Recent experiences with this kind of integration suggest that there may be some possible benefits for patients, though cost savings are few and far between. Medicare's experiment with ACOs, though generating muted success, has found better quality among physician-led ACOs.

In a 2013 analysis of the Medicare Advantage market using public data from the Centers for Medicare and Medicaid Services and private data from one large insurer, Austin Frakt, Steven Pizer, and Roger Feldman discovered that vertically integrated plans charge higher premiums even after controlling for quality. That same year, however, health economists David Cutler of Harvard and Fiona Scott Morton of Yale found that there can be advantages to consolidated health systems (these are the oft-cited Kaiser-like entities), including the ability to coordinate care across different practitioners and sites of care. Yet more recent analysis has found that greater physician-hospital financial integration also results in faster spending growth, which may erase any of these benefits.

One particularly convincing explanation for why we typically don't observe the supposed benefits of scale or scope is our tendency to confuse clinical with financial integration. In a commentary published in the Journal of the American Medical Association, health-policy researchers Thomas Tsai and Ashish Jha from Harvard point out that the benefits of care coordination don't require financial integration. Integration of IT systems, the ability to share clinical data, and communication between hospitals is key here.

There is little evidence, for instance, that larger facilities are doing a better job adopting electronic health records than are smaller facilities. Similarly, Tsai and Jha point out that evidence of better outcomes as a result of volume is limited to a small subset of technically difficult surgeries. More broadly, the causal relationship may be misinterpreted — hospitals with significant volume may have that volume because they are known for being high-quality facilities. If this is the case, increasing volumes at lower-quality hospitals would simply subject more patients to lower-quality care.

Reducing duplicative testing and sharing patient data have significant benefits. But doing so requires competent management and engaged physicians, not a large volume of patients. A large hospital can have poor management and a small hospital can have a world-class team: confounding the two would be a big mistake.

Granted, a minimum level of size is necessary to make certain high-value capital investments that would otherwise be difficult to justify. And hospitals do subsidize unprofitable services with highly profitable ones — neurosurgery may help to subsidize psychiatric and substance-abuse services, for instance — a practice that, again, requires a minimum size. But understanding where a hospital falls on the continuum is important. The relationship between volume and outcomes is probably not linear. That is to say, at different levels of volume or size, increasing volume or size has different effects. And perhaps with the exception of small, rural hospitals, it's likely that most hospitals have already reached the size necessary to support these investments. Some may have even surpassed it.

Researchers tend to find that economies of scale and scope do exist — but that they dissipate after about 200 hospital beds. More recent research, led by the former head of the FTC Bureau of Economics Martin Gaynor, breaks this down more specifically along specialty lines and is a bit more generous to claims of scale and scope: Scale economies are exhausted at between approximately 160 and 260 beds, while one estimate finds scale economies even out at 800 beds.

The next question, of course, is whether hospitals have typically reached this threshold. If we generously assume a 300-bed cut-off for economies of scale and scope, about 16% of all community hospitals in the country would be above our threshold. But according to data collected by the Centers for Disease Control and Prevention from the American Hospital Association, roughly 50% of patient beds in the country are located in these hospitals.

What's more, larger hospitals tend to have higher occupancy rates than smaller hospitals — meaning the hospitals with little in the way of efficiency gains are better at filling their beds. The argument, then, that hospitals must continue to expand to take advantage of economies of scale or scope simply can't be true for at least half of all hospital beds in the country.

INCENTIVES FOR CONSOLIDATION

Consolidation in the hospital industry is still a major trend, despite everything we've learned about the negative consequences for patients. This is largely because consolidation isn't driven only by economic theories, but is also facilitated by federal and state-level policies and regulations.

The most recent reshaping of the health-care industry occurred in 2010 with the passage of the ACA, perhaps the most important development in health care since the passage of Medicare and Medicaid in 1965. Since it was enacted, there's been an upward trend in M&A activity in the hospital market. According to data from Irving Levin Associates, tabulated by the American Hospital Association, the number of mergers has nearly doubled from 2009 to 2014.

Correlation is not causation, of course, but there are specific features of the ACA that encourage consolidation. For starters, as noted earlier, the ACA's experiments with ACOs mean that larger organizational structures might make more sense to hospital administrators. Additionally, the ACA has imposed a moratorium on new physician-owned hospitals, restricting the entry of new firms into the health-care industry and limiting potential competitors for hospitals.

Independent of the ACA (or the '90s backlash against managed care, discussed above), states also maintain regulations that favor large, incumbent hospitals. "Certificate of Need" laws, for instance, require prospective entrants into the market to request approval from the state before embarking on expansion. New York, the first state to enact such a law, did so in 1964. A 1974 federal law incentivized more states to do the same with additional federal funding. By 1978, 36 states had such laws, all of which are still in force today. Simply put, by restricting entry into the market, CON laws reduce competitive pressure on existing hospitals (which are in turn protected by regulatory fiat). One important justification for CON laws was that they would help fund indigent care — but, as it turns out, hospitals in CON states provide no more indigent care than do those in non-CON states.

Other state policies play a role here as well. State governments themselves are often the biggest employers in their states — yet they rarely act like it. Large employers like Boeing have routinely contracted with organizations (often ACOs) that take a more "value-based" approach to medicine. Payments are often tied to particular outcomes. Yet most states have trouble even introducing "tiered networks," where higher-quality hospitals have lower cost-sharing. Two major exceptions are Massachusetts and Maine, the latter of which has a tiered co-pay system based on quality metrics collected by the state.

The importance of payment systems in encouraging consolidation cannot be overstated. When payers do not differentiate their payments based on quality, or when patients have no incentive to use lower-cost providers, hospitals have little incentive to pay attention to these dimensions. The focus, then, often turns to maximizing revenues — and consolidation is a powerful way to do so.

Differences in state policies have resulted in significant variation in market concentration across regions. A 2015 NBER working paper by Zack Cooper, Stuart Craig, Martin Gaynor, and John Van Reenan found that hospital prices are positively associated with regional indicators of hospital market power. Furthermore, they found that this discrepancy is primarily a function of the private insurance markets and that regions spending less on Medicare do not necessarily spend less on health care overall.

A PRESCRIPTION FOR STATES

As demonstrated above, the consensus of economists is that hospital consolidation (particularly the acquisition of competing facilities) is harmful — almost always raising costs and rarely improving quality. But even if consolidation offered some measurable benefits to patients, we should still be skeptical. As Thomas Tsai and Ashish Jha, the health-service researchers at Harvard, put it in their commentary, "Higher health care costs from decreased competition should not be the price society has to pay to receive high-quality health care." American health care is already uniquely expensive and immensely wasteful. Rather than acquiescing to the demands of hospital administrators, we should instead demand more for what we're already paying. And here, well-designed policy can be crucial.

Generally, the appropriate policy responses fall into one of two buckets — either supply-side or demand-side reforms. Reforms that address the supply side focus on removing barriers to entry or otherwise making the landscape directly more competitive. Demand-side changes don't directly affect competition, but instead seek to improve the dynamics that take advantage of a competitive market. For either type of reform, much of the responsibility for policy changes lies with states.

Regarding policy responses, antitrust is perhaps the most traditional tool in the pro-competitive toolkit. At both the federal and state levels, antitrust enforcement is critical. Proper review of potentially harmful mergers can have important effects.

Some initial progress is already being made. In December 2015, the FTC announced that it planned to block the combination of two large Chicago-area hospital systems, Advocate Health Care (already the state's largest health system) and NorthShore University HealthSystem. The merger would have created a 16-hospital powerhouse that would have dominated the hospital market in the North Shore area of Chicago.

An active antitrust agency that enforces its own guidelines sends a powerful signal to hospitals considering mergers — possibly deterring some of the most harmful deals. The ability to have courts order divestment is equally important. But the fact remains that no antitrust agency can be expected to review every single merger that occurs, nor should they challenge every merger that occurs. Knowing when to leave markets alone is just as important as knowing when to intervene.

The role of antitrust, however, consists of more than just taking mergers to court. Martha Coakley, then-attorney general of Massachusetts, sought in 2014 to reach an agreement with Partners Healthcare in their attempt to acquire three hospital systems in the state. Instead of litigating the merger, Coakley worked out a deal that would limit the anti-competitive effects of the consolidation. While the deal was ultimately rejected by a judge and the merger was thereafter abandoned, this approach can serve as a template for other state attorneys general.

But focusing exclusively on antitrust enforcement is a high-risk proposition. When merger challenges fail, they can set precedents for future mergers. That's why most of the policy responses to hospital consolidation should originate with states, but outside of the antitrust system. After all, given that health-care markets are local, it makes sense that much of health-care regulation should happen at the local level too.

As discussed above, CON laws are protectionism at its finest. There is little evidence that they serve the public interest, and they should be eliminated wherever they are found. Removing demand-side incentives to consolidate and raise prices is important as well. States should serve as value-based purchasers of health care, prioritizing outcomes for patients. Not only can this put pressure on hospitals, but, as the largest purchasers of care, states can also demand transparency — on quality and price.

Many states are doing this already through all-payer claims databases (APCDs) that will collect claims data from every insurer operating in the state. Successful APCDs (as in Colorado, for instance) provide easily accessible information to patients who are interested in knowing how much a procedure will cost them. This data can also arm insurers with information that helps them better negotiate with hospitals — not necessarily preventing consolidation, but limiting its harmful effects.

Simply put, hospital consolidation has few positive effects and many harmful ones. Injecting competition into the market, once it's gone, is difficult. But a variety of reforms at the state level can help minimize the negative effects that market power has on patients and payers. These should be imperative for policymakers who want to make the health-care system more affordable, effective, and patient-centered.