Helping Work Reduce Poverty

The problem of poverty in America has been an intractable one, despite nearly a century of public programs attempting to alleviate it. The government spends $1 trillion a year at the federal, state, and local levels, and yet 21% of children under the age of 18 live in families with incomes below the federal poverty threshold. Our anti-poverty programs clearly aren't working as well as they should. To find better solutions, we need to find the source of the problem.

In 2003, my colleague Isabel Sawhill and I conducted an analysis of factors thought to influence poverty by modeling the impact of changes in each factor on the poverty rate. Based on nationally representative data from the U.S. Census Bureau, we modeled the effect on poverty rates if all non-elderly and non-disabled family heads worked full time; if the same proportion of children lived in married-couple families as in 1970; if all family heads had at least a high-school degree; and if the amount of cash welfare received by families were doubled.

The analysis showed that increasing work rates had by far the biggest impact in reducing poverty. In many similar analyses using different approaches and data from different years, all our modeling work showed that the most effective way to reduce poverty is to increase work rates. Moreover, in its annual income and poverty report, the Census Bureau consistently shows that not working yields exceptionally high poverty rates. In 2014, for example, as compared with a poverty rate of 3% among full-time workers, the poverty rate for non-workers was 33.7%.

The unsurprising insight that there is a direct relationship between household work levels and poverty, and that non-work is especially likely to lead to poverty, underscores the importance of declines in work rates in recent decades by various groups of Americans. Between 1969 and 2016, both comparable peak years in the business cycle, there has been a long-term decline in work by prime-age men, from 94.5% to 85.0%, and by young black men, from 76.3% to 53.2%. The news for prime-age women is better, with a historic increase between 1969 and 2016 from 47.1% to 72.0%, although even for women the work rate fell (from 75.7% to 72.0%) over the last decade and a half. The work rate for never-married mothers, a group far more disadvantaged than women and mothers overall, increased substantially, especially between 1996 and 2000, although the rate for this group also declined after 2001.

Significant advances against poverty in the coming years seem likely to depend on significant increases in paid work among the poor — and the reasons are not purely economic. Work means increased earnings, to be sure, which in turn would increase self-sufficiency, increase economic mobility, increase income in retirement, and reduce public expenditures on welfare and related programs. But work is more than just a means of income generation. Work also provides adults and their families with a time structure, a source of status and identity, a means of participating in a collective purpose, and opportunity for social engagement outside family life. A host of studies have connected joblessness to increased risk of family destabilization, suicide, alcohol abuse, and disease incidence, as well as reduced lifespan. Several large reviews of research conclude that unemployment not only reduces physical but also psychological well-being.

These considerations give a sense of urgency to developing a national strategy for reducing non-work. Doing so requires that we understand why work rates are relatively low among some Americans, and what might be done to change that.

REASONS FOR NOT WORKING

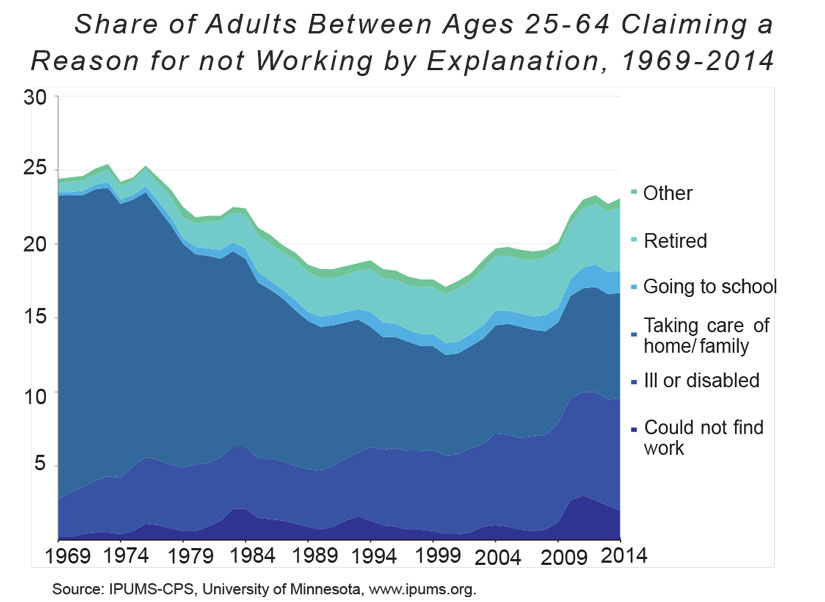

Each year when Census Bureau workers interview a representative sample of Americans, they ask those who say they do not work why they are not working. The responses of adults age 25 through 64 for the years 1969 through 2014, given in six categories, are shown in the figure below.

In 1969, far more people who didn't work said it was because they were "taking care of home/family" than gave all the other reasons combined. In fact, the only other non-work category garnering more than 1% of survey responses in 1969 was "ill or disabled" at 3% (note that the percentages are of the entire sample, not just the non-workers). But the reasons for non-work changed substantially over the years.

By 2014, the percentage of adults saying they didn't work because of home and family responsibilities had declined by 65% to only around 7%. Much of this change is due to changing gender norms that led to the remarkable increase in employment by women, especially mothers, since the 1960s. In contrast, all the other categories of reasons for non-work increased. The percentage who said they had retired had increased to 4.3% from well under 1%. With about 10,000 Baby Boomers retiring each day, and significant numbers of them able to retire early, this trend can be expected to continue. The percentage of non-working adults (age 25-64) going to school had increased from almost zero to 1.5%. As measured by percentage increases, the biggest increases in reasons for non-work were in "ill or disabled" and "could not find work," the former from 2.6% to 7.6%, and the latter from only 0.2% to 2%.

It seems appropriate to assume that the "going to school" category is a good thing, as more Americans age 25 or older are attempting to increase their skills or other work-related abilities. This leaves "retired," "ill or disabled," and "could not find work" as the major areas of opportunity for increasing the nation's work rates.

As a cause of non-work, retirement is a little tricky. Although the figure shows that the retirement category has expanded at a slow and steady pace since 1969, according to a recent study by the Bureau of Labor Statistics, since 1992 the share of almost every age group in the workforce between 16 and 54 has been declining. By contrast, Americans between 55 and 64 years of age, 65 and 74 years of age, and even over 75 years of age are working more than ever, and all these trends are projected to continue at least through 2022. Work rates for those over age 55, then, are moving in the right direction. Among the reforms that have been discussed to incentivize people to continue working and delay claiming Social Security have been increasing early-retirement reductions, paying yearly bonuses for workforce participation, and establishing a lottery system for those who work past 62 with the payout determined as a percentage of the previous year's income. All of these are generally reasonable ideas.

While work rates for those over 55 are trending upward, among the ill and disabled, trends are moving in the opposite direction. The case for boosting employment among the disabled has recently been made in these pages by Scott Winship (see "How to Fix Disability Insurance" in the Spring 2015 issue) and in The Declining Work and Welfare of People with Disabilities by Richard Burkhauser and Mary Daly. Two points should guide consideration of how work can be boosted among those who are now enrolled in the Supplemental Security Income program for the poor, elderly, or disabled, and among disabled people receiving Social Security Disability Insurance. The first is that a huge number of Americans are receiving benefits from both programs. In 2016, there were 7.1 million adults over age 18 on SSI and 8.9 million on SSDI. Among these adults are many who could work, especially if provided with proper incentives and training.

The second is that the politics of improving these programs has proven very challenging. In 2015, for instance, Congress willfully passed up a golden opportunity to enact legislation to tighten standards for admission to both SSI and SSDI or to authorize experiments that try to provide training, help with finding a job, and increased financial incentives to encourage people applying for or on disability programs to work. This opportunity arose in highly predictable fashion because the trust fund that pays for SSDI benefits was close to being empty and Congress had to do something or payments would stop — an unthinkable outcome for elected officials. But rather than tighten admission standards to SSDI or enact reforms that increased the likelihood of work, Congress punted by covering the shortfall in the SSDI Trust Fund by taking money from the Social Security Trust Fund. This action by Congress, which amounts to taking the easy way out, justifies the conclusion that reforms to boost work rates among the substantial number of adults on SSDI and SSI are highly unlikely. This conclusion is especially disappointing because the Social Security Administration sponsored a project called the Youth Transition Demonstration, which showed that many young people on SSI and SSDI are capable of working and that their work rates can be increased with carefully designed programs that emphasize skill development and finding work. It is not clear that these employment programs would save money, but if aggressively implemented some of the young adults on both programs could be helped to work.

The bottom area of the figure above represents the share of people who were not working who said they could not find jobs. In 2014, about 2% of adults said they could not find a job. If applied to the entire population age 25 to 64, that 2% represents about 3.4 million working-age Americans. The fact that the area under the curve roughly follows the level of unemployment in the economy provides modest evidence that non-workers may actually have looked for work but failed to find any. In addition, the fact that the sharpest rise in the share of adults giving this reason for non-work peaked during the years of the back-to-back recessions of the early 1980s and during the years after the Great Recession (2007-2009) gives us additional reason to believe that many of these non-workers did seek a job without success. On the other hand, we know very little about how hard they looked, how many jobs they applied for, or whether they used the U.S. Employment and Training Administration, which provides help to job-seekers in 3,000 locations throughout the country.

PROMOTING WORK

There are clearly many millions of adults in America who are capable of work but who do not work, greatly reducing the economic prospects for themselves and members of their households — not to mention the broader economy. Given the range of personal and public benefits that accompany work, there is widespread agreement that helping people work is a useful government function. And we are not clueless or helpless on this front. Some existing policies — both in the welfare system and among policies intended explicitly to increase labor-force participation — do appear to make a difference and could be built on, even as we experiment with novel approaches.

There are currently about 744,000 adult beneficiaries of the Temporary Assistance for Needy Families Program, about 5 million able-bodied beneficiaries between age 18 and 49 without dependents on the Supplemental Nutrition Assistance Program, and around 6 million able-bodied, non-elderly adults in housing programs. The overwhelming majority of these groups are capable of work, at least on a part-time basis. TANF has strong work requirements, but the work requirements in SNAP and housing programs are much weaker. The strong TANF requirements were enacted in 1996 and implemented by states and localities the following year, although some states had already implemented some of the requirements even before the federal legislation was enacted. We can examine the impact of the TANF work requirement to gain some idea of the possible impact of adopting similar work requirements on the prime-age and able-bodied beneficiaries of SNAP and housing programs.

The TANF program has several features that encourage recipients to work. First, beneficiaries are limited to receiving five years of the TANF cash benefit. This restriction is seen as a way to send a message that, as the program's name suggests, TANF is temporary and recipients must find a way to support themselves over time. Second, recipients are subject to a work requirement that encourages them to engage in activities to prepare for or find work. States are free to design their own programs in this regard, but all states must have a program that aims to get recipients into the workforce sooner rather than later. In addition, the program must include a system of sanctions by which recipients who do not meet the state-determined work requirements see their benefits reduced or even terminated.

Did these demanding reforms increase work rates among mothers on TANF? Never-married mothers had much lower work rates than mothers overall before the mid-1990s, when welfare reform was enacted. In 1992, for example, the work rate of all mothers was 63.9%, which exceeded the 44.4% rate for never-married mothers by nearly 45%. During the years leading up to welfare reform, the work rate of both groups of mothers increased modestly. But following welfare reform, while the work rate of all mothers continued its gentle rise, the work rate of never-married mothers increased dramatically. In fact, in the four years following welfare reform, the work rate of never-married mothers increased by more than 34% as compared with the average of the four years before welfare reform. Compared with this large increase, the increase in work rates for all mothers over the same period was a little over 7%.

The recessions of 2001 and 2007-2009 reduced the work rates of never-married mothers (and every other demographic group). For never-married mothers, the decline was from a high of 66.5% in 2000 to a low of 58.2% in 2011. But as the economy recovered from the Great Recession, the work rate of never-married mothers began to move up again. The 65.1% rate for never-married mothers in 2016 is about 41% above the comparable rate in the five years before welfare reform. It seems reasonable to conclude that, although varying somewhat with the health of the economy, the work rate of never-married mothers has permanently increased — the most important goal of welfare reform.

In addition to the work data on never-married mothers, many states followed mothers who left welfare to determine whether they were working. In a review of all these studies, Greg Acs, Pamela Loprest, and Tracy Roberts of the Urban Institute found that around 70% of the single parents who left welfare worked at some point in the year following their exit and that about 60% of them were working at any given time.

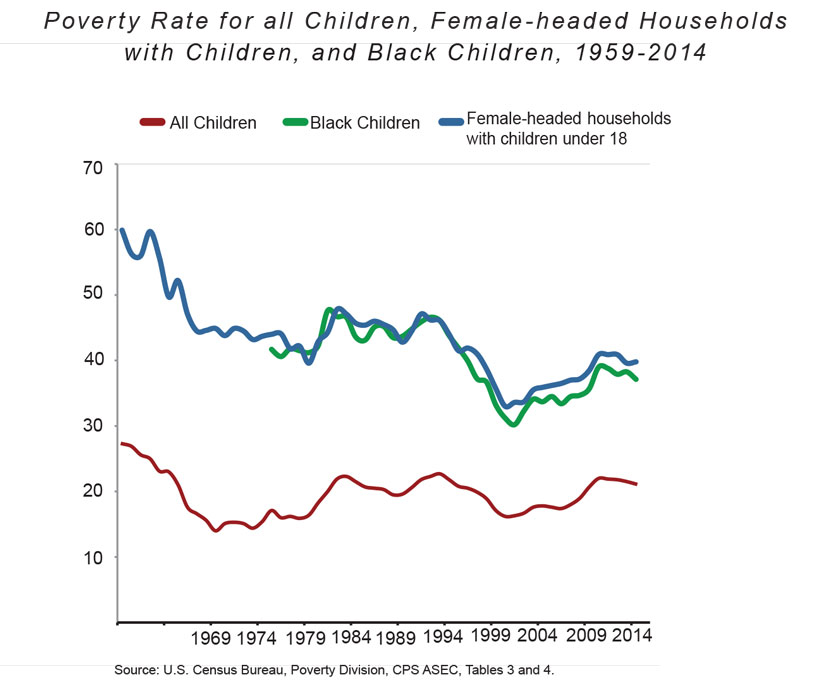

As expected, the increasing work rates of mothers, especially never-married mothers, led to a substantial decline in poverty among both families headed by single mothers and black families, which are disproportionately headed by single mothers. In conjunction with the period of increasing work by single mothers, as the chart below shows, the poverty rate among children in these families fell substantially beginning in roughly 1993 until the recession of 2001. By contrast, the poverty rate among all children fell by only about 50% as much over the same period, as shown in the figure below.

A series of other reforms over the past several decades have also attempted to improve work rates among recipients of public benefits. There is a long-standing assumption that welfare benefits by their very nature constitute a work disincentive because, as recipients begin working, their benefits are reduced at rates and in earnings ranges that vary greatly across welfare programs, thereby imposing a kind of tax on earnings (in addition to regular taxation). There are some circumstances, albeit rare, in which the "tax" on declining welfare benefits exceeds 100% of earnings. As a counter to this work disincentive and for other reasons, since at least the 1980s the federal government and many states have been creating new programs and modifying old programs to reduce work disincentives in means-tested benefits programs (those that provide benefits only to people below an income and resources cutoff level) and in the tax code. The new programs include the Earned Income Tax Credit and the Additional Child Tax Credit; the programs expanded or modified to decrease their work disincentives include Medicaid, SNAP, and child care, especially the Child Care and Development Fund.

Today the EITC, the most generous of these programs, provides a maximum annual cash benefit of around $5,600 for a family with two children and $6,300 for a family with three children. Taken together, these programs increase the income of millions of low-wage American workers — both singles and married couples — with children. And although these benefits provide tens of billions of dollars to low-income families with children each year, virtually none of them count in the definition of income used to calculate the official poverty level. In other words, poverty is actually lower than shown above when we count the value of all government-provided benefits.

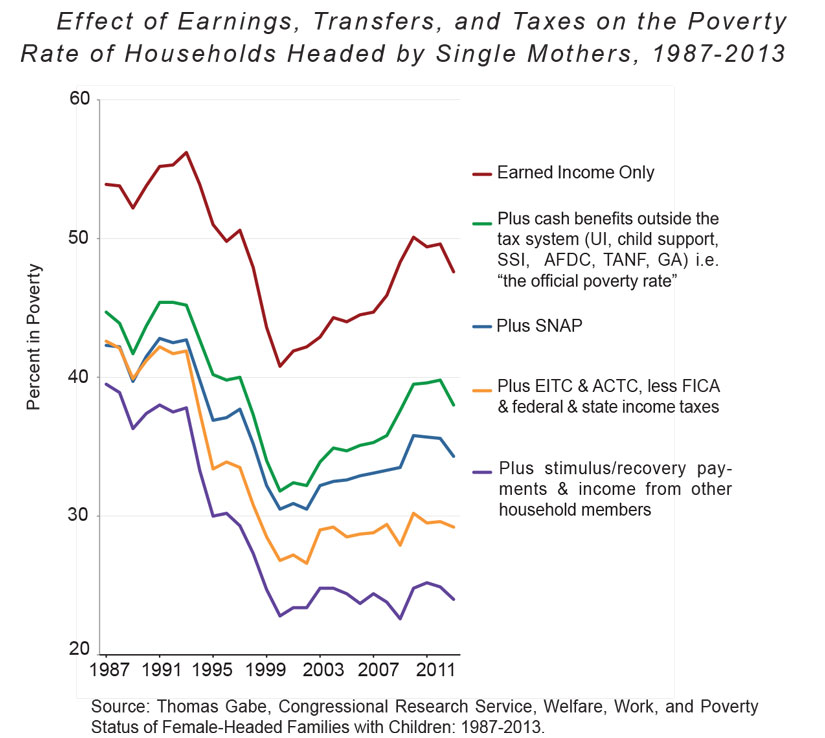

A fascinating analysis that focuses directly on work by single mothers combined with benefits from the work-support system was recently conducted by the nonpartisan Congressional Research Service. The CRS analysis, which covers the years between 1987 and 2013, aims to examine how increased work by single mothers, combined with the earned benefits provided by the government's work-support system, affects the poverty rates of female-headed families with kids. The figure below summarizes its findings.

As these various work-support benefits are added to the earnings of single mothers, the poverty rate falls substantially. In fact, during 2013, the last year analyzed by CRS, the poverty rate for single-mother households was cut in half, from 48% to 24%, primarily by receipt of work-support benefits. The figure leaves no doubt that, averaged across all low-income single mothers who work, the work-support system both provides a substantial work incentive and greatly improves the financial well-being of many mothers and their children.

Thus, the federal government and the states have fashioned policy to both increase work rates and boost the income of low-wage workers with children. Welfare reform and its effects on work and poverty show why the dual policy of increasing work rates and supplementing the income of low-wage workers, especially those with children, is good policy.

But the success of welfare reform and the work-support system in boosting work rates and reducing poverty raises three questions that merit further scrutiny. First, if work reduces poverty and produces a range of personal and public benefits, why don't we have more of it? Second, what of the mothers who were not able to obtain and hold a job? They and their children are not doing well and are being mostly ignored by policymakers, as Republicans exaggerate the successes of welfare reform, which are real, and liberals condemn welfare reform but propose no solutions except restoring the old system, in which poor mothers have an entitlement to cash income as they did before welfare reform. And third, what has happened to the spark of innovation that characterized state programs in the years leading up to and immediately following welfare reform?

It now appears that many states take steps to keep destitute families off welfare and do little to reach out to floundering mothers who are having difficulty juggling work and child-rearing. Simultaneously, states use the flexibility provided by TANF spending rules to spend the funds on social problems other than reducing destitution and supporting work programs. As a result, many fewer poor families receive a TANF cash payment today than in the years before welfare reform, and it appears that many families with children, especially those headed by a single mother, at the very bottom of the income distribution are worse off than before welfare reform.

None of these problems is an inherent part of a demanding and appropriately paternalistic welfare program that requires people to work and disciplines them if they do not. Rather, the problems, as is so often the case with social policy, are functions of the implementation of the reforms. Thus, it is reasonable to at least explore how to impose work requirements similar to those in the TANF program in the SNAP, housing, and Medicaid programs while minimizing the problems that have accompanied the implementation of TANF.

WELFARE TO WORK

In a recent report entitled Opportunity, Responsibility, and Security from a working group of conservative and progressive scholars organized by the American Enterprise Institute and the Brookings Institution, a compromise was struck specifying that strong work requirements in welfare programs should not include sanctions that could lead to recipients being denied benefits unless they were offered a job or other "constructive activity" but refused to work. In other words, progressives were willing to accede to strong work requirements on the condition that serious penalties would not be imposed unless the beneficiary had been offered and refused a job or similar activity. If followed, this approach would reduce the problem of destitution among families with children at the bottom of the income distribution. Conservative members of the working group concluded that this stipulation was reasonable and agreed to it.

The nation has a long history of trying to make sure jobs are available to those who want to work. Economists and many policymakers believe that broad instruments of fiscal and monetary policy can stimulate or moderate GDP, which in turn has major implications for the availability of jobs. Fiscal and monetary policy may be partially effective, but the economy, the GDP, and job creation do not respond to them in any clearly understood, let alone controlled, fashion. The task of helping low-income Americans find jobs is certainly easier during an economic expansion, as in the 1990s when welfare reform was implemented as the economy added well over 24 million jobs between 1992 and early 2001. But policy cannot be based on the hope that the economy will consistently perform in this fashion.

Moreover, even during times of robust economic growth, there are millions of potential workers who, for a variety of reasons, do not work or do not work consistently. Before welfare reform, the view was widespread that most mothers on welfare were not able to hold down jobs and that even if they could they would be no better off financially than when they were on welfare. But the experience of welfare reform proves otherwise: In 1995, the Aid to Families with Dependent Children program that TANF replaced had 4.9 million families on the rolls, most headed by single mothers; in 2015, TANF had 1.6 million families, a decline of 3.3 million families.

If the Urban Institute review of welfare-leaver studies referred to above is correct, approximately 70% of the single parents who left welfare worked during the following year. Thus, the experience of welfare reform shows that millions of poor mothers were capable of work when given the right incentives, including a strong push from work requirements, sanctions, and time limits. But what about the other 30%? What about recessions? What about mothers who work part time but need and want to work full time? What about the mothers who cycle on and off the welfare rolls, often because they have difficulty holding onto jobs and finding new ones?

If the price of including strong work requirements backed by TANF-like sanctions in SNAP and housing programs is the guarantee of a job for anyone who can't find one, the federal government, in partnership with state and local governments, has experience running such programs. In addition, there is research, some of very high quality, that supplies evidence about how to conduct these programs in ways that produce increased work and earnings.

Though difficult to establish and operate, some of these programs should be considered promising. But none has enough evidence to justify large-scale implementation. Therefore, we should give states the opportunity, on a competitive basis, to try their own approaches to guaranteeing employment while implementing strong work requirements in SNAP (which at least 10 states are already doing on an experimental basis) and housing programs.

States would apply to the secretary of agriculture in the case of SNAP and the secretary of Housing and Urban Development in the case of housing programs. The proposals would include rigorous evaluation plans so that good results could be replicated by other states. The secretaries would be authorized to waive any provisions of law necessary for the state to implement its work plan on the condition that a job be offered and refused before benefits from the respective programs could be substantially reduced or terminated.

What are the promising approaches that states could try? The earliest programs, sometimes called public-service employment (PSE), that provided jobs subsidized by public funds were implemented during the Great Depression in the 1930s. The general idea of these programs was to identify work, mostly unskilled, that government does or could do and to use public funds to pay people to do that work. In an older (1999) but still relevant review of PSE programs, David Ellwood and Elisabeth Welty of Harvard showed that such programs have been used to create counter-cyclical employment, to provide employment for targeted groups with disadvantages (such as mothers on welfare, unemployed youth, and other difficult-to-employ groups), and as a way to ensure that people do not receive welfare benefits without doing something to serve the public good.

Ellwood and Welty also concluded after their thorough review that program administrative costs can be reasonable and that a few programs have achieved long-term employment and earnings gains for participants. In addition, especially in the original PSE programs during the Great Depression, work products of public value such as roads and park facilities were often produced, albeit sometimes at a cost of displacing workers who were employed in jobs similar to the PSE jobs.

More recently, one of the most notable examples of a successful PSE program was conducted by the research company MDRC. (I am a member of MDRC's board of directors.) Called the National Supported Work Demonstration, the program tested the effects of a 12- to 18-month public job in which participants received close supervision. The job programs were run by local non-profit organizations at 15 sites across the nation. One group in the program consisted of long-term AFDC recipients who share many of the work-related problems (transportation issues, problems with children's health and education, chronic illnesses, poor education, lack of work experience) characteristic of today's TANF, SNAP, and housing recipients who face employment issues. After the public-service job ended, recipients showed increased work rates, increased earnings, and reduced welfare dependency relative to a randomly assigned control group.

Another type of work program that has received a lot of attention in recent years is called "transitional work." Although there is some variation from program to program, the typical transitional-work program has three major components: a short-term (often around 9 to 12 months) wage-paying job like PSE jobs; job-related assistance and services; and job-search and placement services that sometimes include follow-up after several months of work on the new job.

The Department of Labor was given $45 million by Congress in its 2010 budget to study these transitional-jobs programs, and among the research pursued with those funds was a historical overview of transitional jobs that included a comprehensive review of the research literature. Written by Dan Bloom of MDRC and entitled "Transitional Jobs: Background, Program Models, and Evaluation Evidence," the review comes to the conclusion that, although research demonstrates that transitional jobs can be implemented on a large scale and can provide useful work experiences for various disadvantaged groups including welfare recipients, the long-term impacts on employment and earnings are less certain. Even so, there are a small number of carefully evaluated transitional-jobs programs, such as the National Supported Work Demonstration program, that have produced long-term effects on employment and earnings.

Yet another possibility for state work programs is an approach now widely known as "sectoral employment." The basic premise of sectoral employment is that helping disadvantaged youth and adults learn the skills and gain the work experience that will qualify them for good jobs that are available in the local economy will lead to permanent employment in well-paying jobs. These programs are not for everyone because they often employ screening to identify participants who are the most job ready, who could benefit from skills training and job experience, and who would be the most likely to succeed in a program that involves intense training. Program staff identify good jobs available in the local economy and then work with employers to isolate the skills required to succeed in the job. It is these skills that they focus on in developing their programs.

One of the first carefully evaluated programs of this type was the Sectoral Employment Impact Study conducted by the non-profit company Public/Private Ventures and completed in 2010. Implementing their program in three sites, the company found quite substantial effects. Program participants earned about $4,500 more than randomly assigned controls in the second year of the program, a very large gain as compared with the results of any type of training program implemented in the last several decades. Moreover, the earnings gains occurred in every subgroup of participants including blacks, Latinos, immigrants, young adults, and even former prisoners.

A similar study called WorkAdvance, conducted by MDRC and implemented in four cities, also produced overall effects on both employment and earnings, with statistically significant gains in three of the four sites. Again, effects were noted in various subgroups, including the long-term unemployed, a group that tends to be highly disadvantaged. The key characteristic of these programs is the identification of jobs and job skills in demand in the local economy, which in turn requires competent program staff who can identify the right skills and then design and implement a program that successfully teaches those skills.

One more program deserves a brief mention. During the Great Recession, when the rolls of all the key welfare programs were increasing, Congress and the president gave states a flat sum of $5 billion to pay additional welfare benefits or to subsidize wages for employers willing to provide jobs to welfare recipients or people at risk of entering welfare. To everyone's surprise, 39 states and the District of Columbia used $1.3 billion of the money to subsidize 260,000 jobs, mostly in the private sector. Likely in part because the money from the federal government came quickly and because states had their hands full trying to stretch their finances (which were deeply in the red), only one state — Florida — conducted a useful evaluation of its work-subsidy program, and even that was a retrospective study. Nonetheless, based on a comparison group (but not one that was randomly assigned) individuals in the job-subsidy program experienced a $4,000 increase in income compared with the year before the subsidy program began, while members of the comparison group experienced only a $1,500 increase.

A clear majority of the employers in the program said they created jobs that they would not have created without the subsidy. This study seems to show that there is a willingness in the states to conduct job-subsidy programs, a willingness among employers to participate in them, and some reason to think that such programs can increase participant earnings.

REVIVING WORK

For most people, work is an essential feature of a flourishing life. But work effort by American males has been in decline for well over four decades, while that of various groups of females, after increasing rapidly for several decades, has declined somewhat since the turn of the century. Work should therefore be at the center of our efforts to improve the ability of the welfare system to help the poor to rise.

And we know how that can happen. Most of the mothers who left welfare in the wake of the reforms of the 1990s took jobs and were able to take advantage of work-support programs such as the EITC. As a result, the poverty rates among the families involved declined significantly, and they remain lower today than before welfare reform.

The strategy of increasing work and reducing welfare use through time limits, work requirements, and work-support benefits could be applied to millions of able-bodied adults now receiving benefits from SNAP and housing programs. There is a possibility that, given the success of welfare reform in increasing work rates and reducing poverty, a grand bargain could be reached in Congress that would produce bipartisan support for these programs if states would guarantee a job offer before imposing serious sanctions. A review of the existing evidence and research provides abundant reasons to believe that states have real experience with programs that provide jobs to youth and adults with job-related barriers, and that some of these programs increase future employment and earnings.

If well implemented, which is no small matter of course, job programs not only have the potential to reduce destitution at the bottom of the income distribution but also to improve the future prospects for participants' employment and financial security. Many years of experience with testing and learning will be required for states to develop successful jobs programs. But in order for that essential learning to begin, carefully evaluated state demonstrations that boost the work requirements of SNAP and housing programs while providing job experience for those who can't find jobs on their own are a clear and appropriate next step.